This post’s titular question is probably the most important one for the

The general expectation is that the Fed will start its rate raising spree as early as June or at latest in July. It is based mostly on the really good performance of the US economy, particularly the employment situation. At the same time, the language of the latest FOMC statement seems a bit more hawkish than that of the January meeting. The extent of this increase in hawkishness is debatable, in my opinion, but the change of tone is evident.

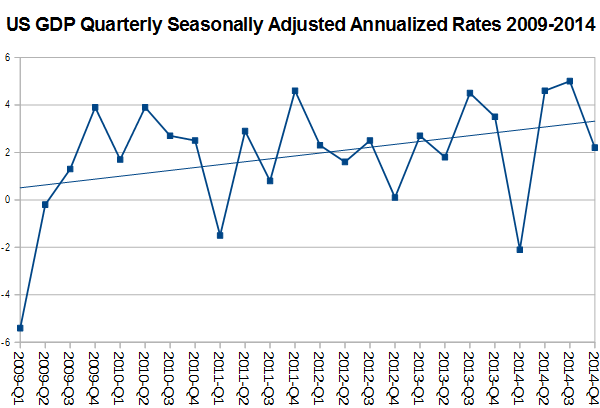

It is useful to look at the US macroeconomic indicators — how they changed during the period of the low interest rates and the quantitative easing. The GDP chart below shows an increasing rate of growth of the US economy during the last five years:

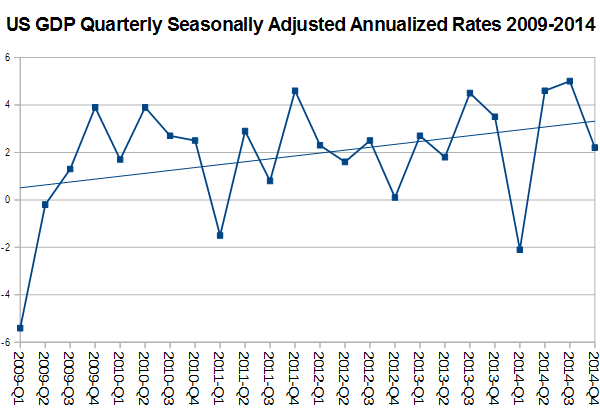

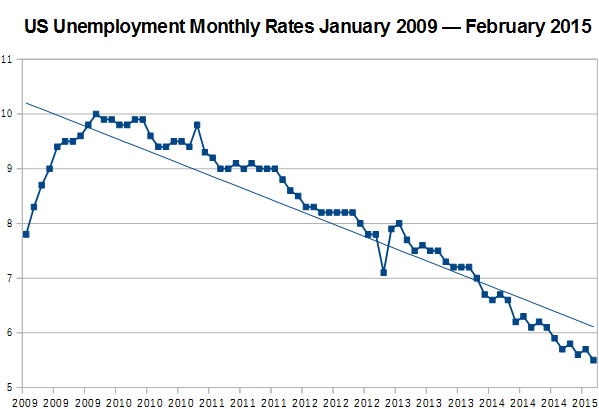

The unemployment chart will tell us the same story — the period of

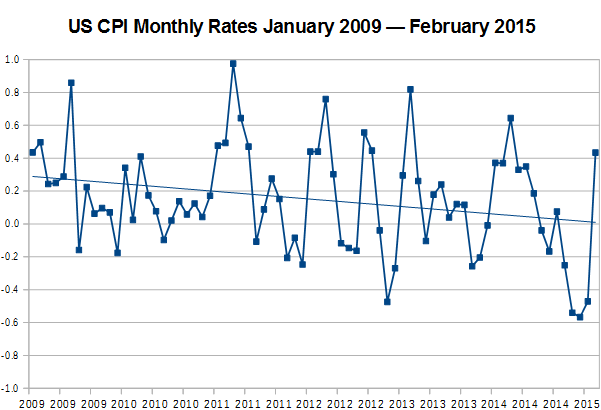

However, probably the most unexpected picture is revealed by the consumer price inflation chart for the same period. As we can see, the CPI rate is not only far below the widely accepted target of 2%, but is also declining according to the attached linear regression trend line:

Federal Open Market Committee is very cautious in their interpreting of these optimistic albeit ambiguous data. Although the latest FOMC projections show a continued improvement in both the employment and the economic output through the year 2017 combined with the liftoff in CPI, it is important to remember that the Committee’s current Chair is a proponent of the gradual shift in rates when it comes to an economic recovery. If you read Janet Yellen‘s latest speech on the topic of normalization of the monetary policy, you will realize that she puts the risks of raising the funds rate too early much higher than the risks associated with acting late. She does not seem concerned when it comes to the risks of

At this point the evidence indicates that such vulnerabilities do not pose a significant threat, but the Committee is carefully monitoring developments in this area.

My own forecast for 2015 echoes my point of view that Janet Yellen will not risk to break the recovery at its current stage without a real confirmation that CPI will reach its 2% goal. And I do not believe that we will see such confirmation soon given what we see now. Despite the fact that the Chair’s speech is talking about a rate increase in 2015 in plain text, I would not give it too much thought. After all, everything will depend on “evolving judgments concerning the implications of incoming information for the economic outlook.” And how do you see the future of the US interest rates?

When will Federal Reserve raise US interest rate?

- No rate increase â new QE will be introduced in 2015 instead. (31%, 4 Votes)

- June (23%, 3 Votes)

- Not in 2015 (23%, 3 Votes)

- September (15%, 2 Votes)

- July (8%, 1 Votes)

- April (0%, 0 Votes)

- October (0%, 0 Votes)

- December (0%, 0 Votes)

Total Voters: 13

![]() Loading …

Loading …

PS: The poll is set to expire before the April 29 FOMC statement will be released.

If you have something to tell other traders about the Federal Reserve and its plans for the future of the US monetary policy, please feel free to do so using the commentary form below.