As you probably know, there are two kinds of orders in MetaTrader platform: pending orders and market orders. Pending orders can be either limit or stop and will be executed when the price reaches some predefined level. Market orders can be either of instant execution or of market execution. The execution type is set by a Forex broker and cannot be modified by a trader.

Instant Execution

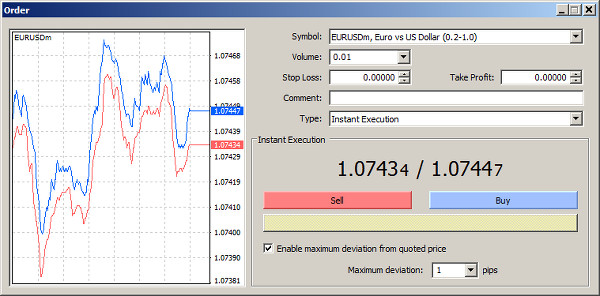

When the instant execution is used, the broker will try to execute your order using the latest price that you have seen in your platform. Consequently, there is a probability that the price changes while your order is processed by the broker. If the change is greater than the deviation parameter specified in the order, the broker will reply with a requote and you can either accept the new price or reject the order execution at all.

The clear advantage of this execution mode is that you can get an order executed at a known desired price. E.g. if you see EUR/USD Ask at 1.07447, you can send a buy order at that price and expect to open a position at that same price or return to you with a requote request.

The disadvantage of instant execution is also evident — you might miss a good trading opportunity when the volatility is high and your broker is sending you requotes one after another.

The sample MetaTrader 4 order creation window with instant execution model can be seen below. Note the maximum allowed deviation input field at the bottom:

Market Execution

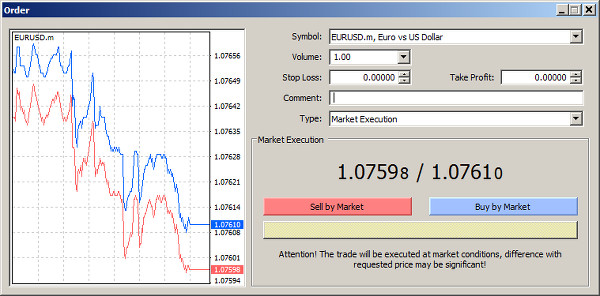

If your broker is using market execution (most ECN brokers are) to process orders, your order will open a position at the broker’s latest price even when it is different from the one you see in your platform. The price may actually be the same as the one you see in the platform, or it may be only insignificantly different, but sometimes, the difference may get quite serious.

On the one hand, market execution allows you to trade currencies without any sort of requotes. It will result in a much faster execution of your orders. It also means nearly 100% guaranteed opening of the position.

On the other hand, slippage (or deviation) can get very big during volatile price changes. For example, if you see EUR/USD trading at 1.07610 Ask price and decide to send a buy order via a broker with market execution, you could end up with a long position at something like 1.07700 open price (9 full pips could be much higher than your planned entry).

Another disadvantage of this type of execution is that brokers, which employ it, will not allow setting

Below, an example of the MT4 trading dialog shows the market execution model. Note the warning of the possible price difference between the currently displayed price and actual execution price:

Conclusion

It is important to understand that the difference between the two models is in fact minuscule and can be experienced only under extreme market conditions. I would advise most traders to stay away from such situations regardless of their broker’s execution type. Getting constant requotes can be as bad for your trading performance as a deep slippage can be.

Apparently, there is no such thing as the best type of execution. You should look at your goals and choose a broker or an account type at your broker (if the company offers account types with both execution methods) appropriately.

PS: Both execution modes are present in MetaTrader 4 and MetaTrader 5 and there is no difference in how those two versions of the platform handle them.

If you have some questions or wish to share your experience trading Forex with instant or market execution style, please feel free to reply using the form below.