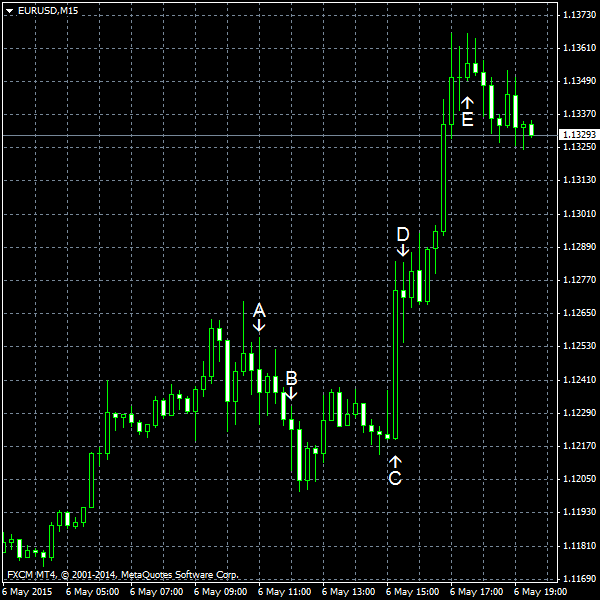

The currency pair was rising steadily before the opening of the European trading session today. The rally did not last long following the

ADP employment added 169k jobs in April after 175k growth in March (revised down from 189k). It also fell short of the median forecast of 200k. (Event C on the chart.)

Nonfarm productivity fell by 1.9% in the first quarter of 2015. It decreased by 2.1% in Q4 of 2014 (revised from 2.2% decline). The productivity declined according to forecasts. (Event D on the chart.)

US crude oil inventories fell by 3.9 million barrels during the week that ended on May 1. It was the first weekly drop since January. The oil reserves are at the highest level for this time of the year for at least the last 80 years. The previous week demonstrated an increase of 1.9 million barrels. A growth of 1.5 million barrels was expected this time. Total motor gasoline inventories increased by 0.4 million barrels. (Event E on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.