Without looking at any charts, my first thought about the strongest major currency during the last five years would have been the US dollar. After all, it was the major winner in the global financial crisis of 2008 when the markets had run for safety while the dollar’s rivals fared poorly. However, further analysis has shown that the biggest winner between 2010 and 2015 was not the USD.

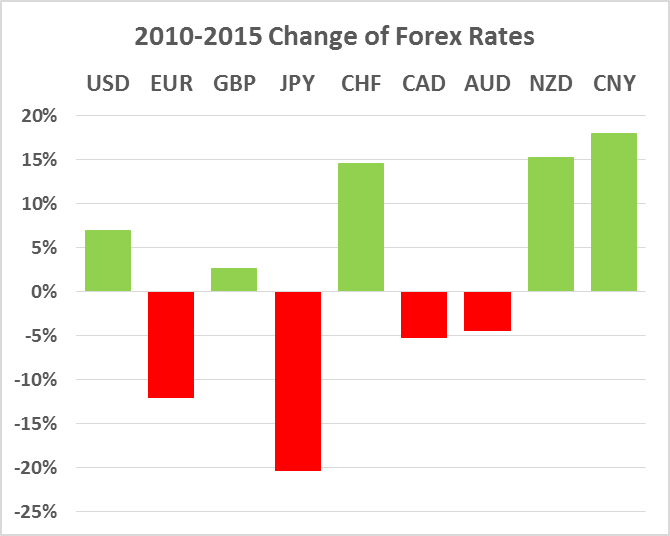

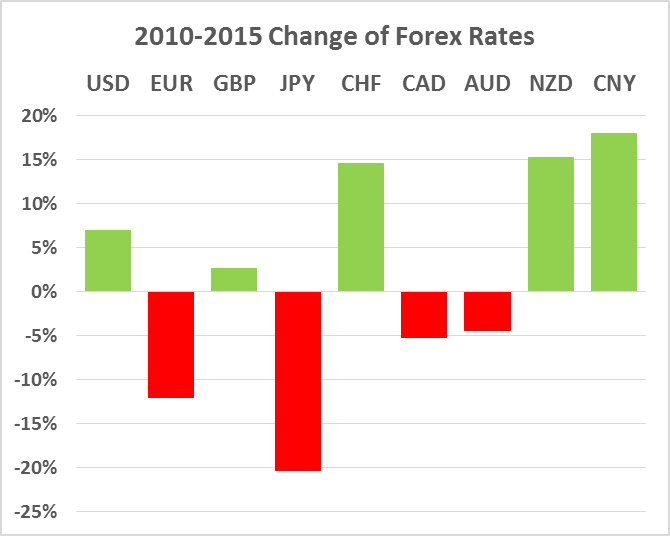

To measure the relative strength of the currencies, I have picked eight usual majors and the Chinese yuan as a very important emerging market currency. Then, I have compared the currency rates for all the relevant currency pairs on the first trading day of 2010 (January 4) and the first trading day of 2015 (January 2). Calculating the average gain/loss of all the nine studied currencies resulted in the following histogram of their gains during the 5-year period:

Apparently, it was the Chinese yuan that have shown the best performance among the analyzed currencies. With 17.93% gain against its counterparts, it went ahead of the New Zealand dollar (15.23%), the Swiss franc (14.54%), and the US dollar, which only managed to book 6.91% increase during the same period. Great Britain pound did not change much if you discard the

The clear outsider was the Japanese yen with its 20.34% loss acquired thanks to the aggressive bearish currency strategy, which is still a part of Abenomics. Euro, which suffered from the financial turmoil in PIIGS countries, entered the year 2015 with 12.03% loss. Canadian dollar, which lost a lot of its shine due to the lower oil prices boasts a 5.17% decline, while Australian dollar lost just 4.40% during the 5-year span.

Looking at the first five months of 2015 reveals the following biases in the foreign exchange market for the majors:

Dollar is gaining against the euro:

British pound is winning versus the USD:

Yen is losing to the dollar:

Swissie is doing great against USD (thanks to the SNB’s cap removal):

Canadian dollar is weaker than its US counterpart:

Aussie is falling compared to the greenback:

New Zealand dollar is down too:

Chinese yuan is trading lower than it had started the year:

Obviously, the Chinese currency is no longer a favorite — its place has been taken by the GBP. It is also

My bet is that the strongest currency in the period between 2015 and 2020 will become the euro. It is rather significantly undervalued as of now, it has quantitative easing looming ahead for the next year or so, but it will start demonstrating extraordinary growth trend when the European Central Bank starts giving hints about the future interest rates increases. China will be cooling down slowly; USD will lose its advantage of the “future rate increases”, while the rest of the currencies lack that deep state of being oversold pertinent to the euro today. Except for the Japanese yen, which could be a huge

The currencies in the poll below are sorted according to their strength during the 2010–2015 interval. The resulting currency rate changes will be calculated based on the difference between January 2, 2015, and January 2, 2020. The poll will expire on January 1, 2016.

Which of the major currencies will show the best dynamics between 2015 and 2020?

- Euro (32%, 10 Votes)

- US dollar (23%, 7 Votes)

- Chinese yuan (16%, 5 Votes)

- Japanese yen (13%, 4 Votes)

- Great Britain pound (6%, 2 Votes)

- Canadian dollar (3%, 1 Votes)

- Other (Please specify in comments.) (3%, 1 Votes)

- Swiss franc (3%, 1 Votes)

- New Zealand dollar (0%, 0 Votes)

- Australian dollar (0%, 0 Votes)

Total Voters: 31

![]() Loading …

Loading …

If you want to share some details about your forecast for the strongest major currency during the upcoming five years, please feel free to reply to this post using the form below.