Last week, the development of the Greek debt crisis prompted the Forex brokers to make all the necessary preparations for the July 5 referendum. Brokers cut leverage, removed illiquid currency pairs from trading, convinced traders to close EUR positions before weekend, and switched many pairs, including EUR/USD to

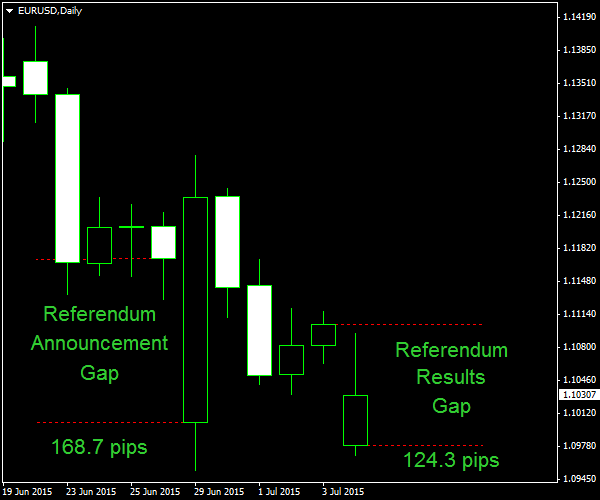

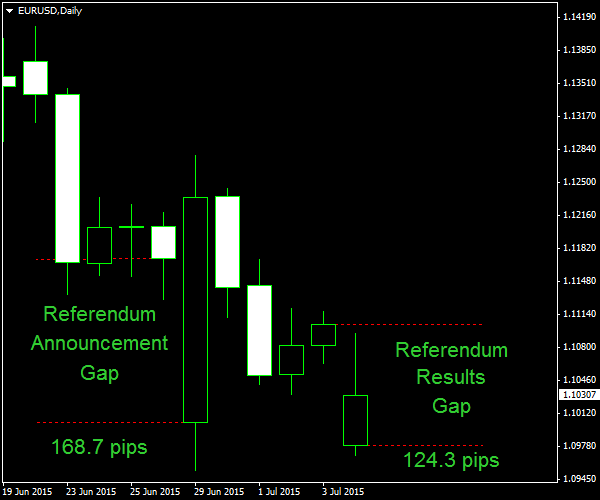

Today, on July 6, it is evident that all those measures very probably an overkill, and that the risk of the referendum voting results spurring havoc in the markets was overestimated. As the chart below shows, the weekend gap following the referendum announcement on June 27–28 was 35% bigger than this weekend when Greek people had actually said their word — 168.7 pips vs. 124.3 pips on EUR/USD. It looks like the market has already priced in the biggest part of the loss for the euro during the week before the referendum, which ended in not a big surprise.

Now, that the Greeks refused to fulfill the proposed austerity requirements in exchange for further financial aid, many traders and analysts believe that the Grexit is inevitable (Greece leaving the eurozone and, perhaps, even the European Union). Such event is very improbable (this short article by Anil Kashyap explains why), but it may pose a new risk to the Forex market, not unlike the one we have passed these last two weekends. So, some brokers may continue to apply their preventive measures against the low liquidity rate spikes.

I, personally, was not affected much by the gap or by the changes in the trading conditions enacted by some brokers. The only effect on my Forex account was that my EUR/JPY short position has moved closer to its target level. And how about you?

![]() Loading …

Loading …

If you want to share more information on how the Greek debt crisis has affected your Forex trading performance, please feel free to reply to this post using the form below.