If you follow my blog, you have probably noticed that I had had two unsuccessful attempts (first and second) to short the Russian ruble following my big hit in December of 2014. This time, I am expecting to enter a long USD/RUB trade based on some simple fundamental analysis with pretty standard technical levels chosen for entry,

The main reason for buying USD vs. RUB this time is the $22.9 billion external debt (principal plus interest) that the Russian Federation has to repay in December this year. The debt is owed by both public and private sectors — all the same, it will apply stress on the dollar supply and will spur the supply of rubles. The December repayment volume is twice as big as November and October combined. At the same time, the Brent grade of oil is trading at $44.86 per barrel compared to $58-$59 per barrel it traded during December 2014. Meanwhile, the international sanctions are still there and will prevent easy borrowing by a number of Russian companies. Moreover, the tensions connected with the Russian warplane shootdown may escalate and increase the financial market volatility in the country.

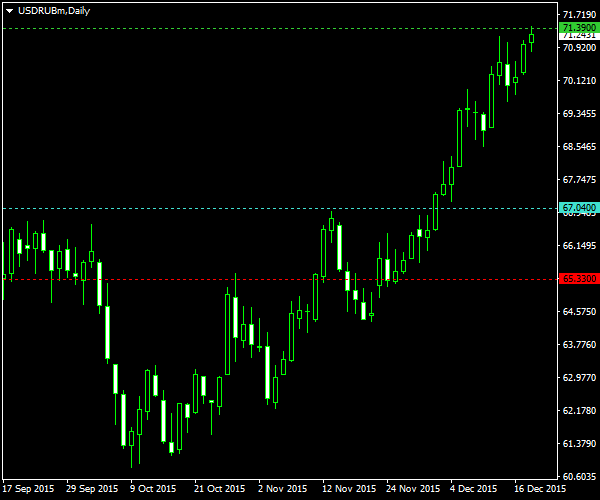

From the technical point of view, I am setting a buy stop pending order on a the current trend’s higher high breakout at 67.04, which is also right above the resistance level formed during September and October. My entry level is marked with the cyan line on the chart below. The

I will also use a trailing stop based on the Average True Range indicator with this trade. And I will cancel the whole setup if the trend fails to form the next higher high and will go below the latest higher low instead.

Update 2015-12-02 16:30 GMT: Long entry triggered during early morning session today at 9:32 GMT. Let’s see if the trend holds:

Update 2015-12-15: Moving

Update 2015-12-18: USD/RUB reached my

If you have any questions or ideas regarding the trade opportunity in USD/RUB currency pair, please feel free to post them using the commentary form below.