About a year ago, I have asked you about the possibility of EUR/USD reaching parity in the year 2015. As of now, it looks like the most voted option — Not this year — turned to be the correct one. Of course, there is a small chance of EUR/USD falling to the bottom during the remaining 9 trading sessions (8 if you cross out Christmas), but it does not look like a real possibility to me.

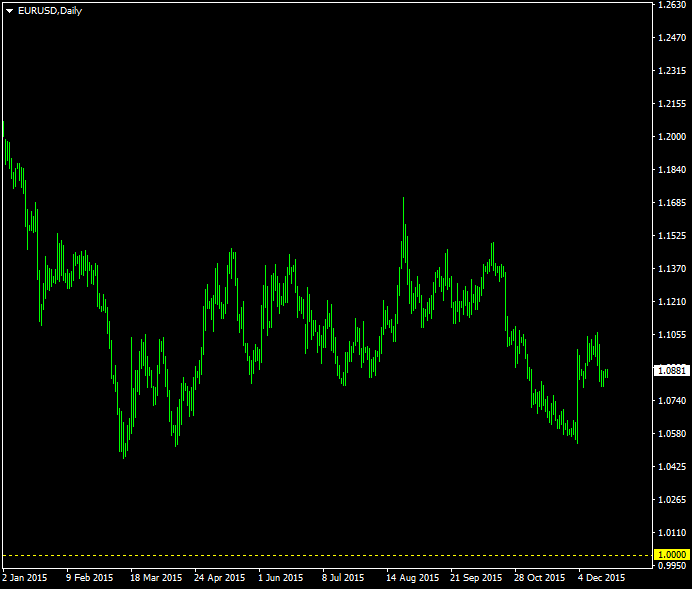

As you can see, the currency pair was trading in a kind of a sideways market with a slight downward bias through all of 2015:

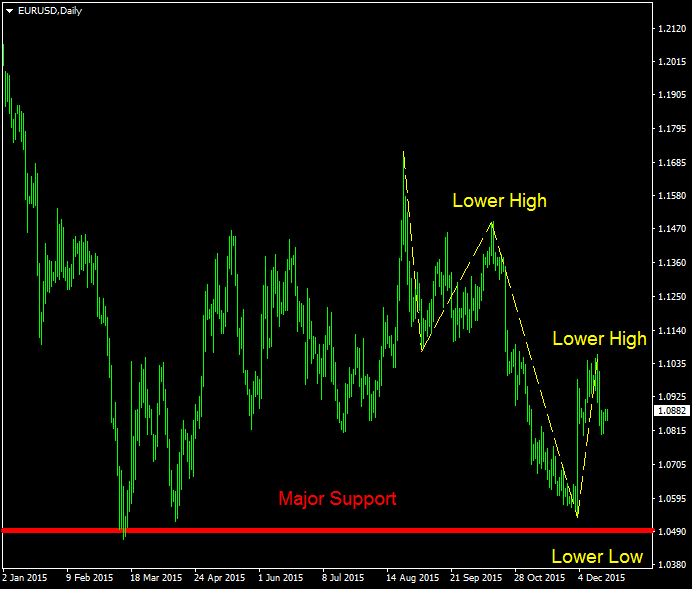

Even though the euro is posting new lower lows and lower highs steadily since August, there is a clear support level significantly above parity level — near 1.0480–1.0500 area:

With interest rate hikes loose in the United States and the quantitative easing enabled in the eurozone, it is hard to see any other future for EUR/USD in 2016 than a steady road down to parity and probably even below it. At the same time, it might the case that all these fundamental factors are already priced in. Such reasoning brings us to a situation when every monetary tightening delay by the Federal Reserve will result in dollar’s weakness while any hints of hawkishness by the European Central Bank will provide support to the euro. In which case, EUR/USD will be going up in 2016 unless both authorities will act according to or in excess of their stated intentions.

My personal view is that the interest rates will drive the Forex market in 2016. The interest rate difference is going to favor the USD over the EUR. That is why, I still believe that we are going to see EUR/USD parity next year.

Where will EUR/USD end trading 2016?

- Above parity (> 1.02) (45%, 10 Votes)

- At or near parity (0.98-1.02) (27%, 6 Votes)

- Below parity (< 0.98) (27%, 6 Votes)

Total Voters: 22

![]() Loading …

Loading …

PS: The poll will be closed on April 1, 2016.

If you want to share your opinion about the future course of the EUR/USD currency pair and how it will affect other Forex pairs in 2016, please feel free to do so using the commentary form below.