Looking back at my forecast for 2015, I see that I am quite accurate at predicting what happens to the USD, EUR, and commodities. At the same time, my

Contents

- 1 EUR/USD

- 2 GBP/USD

- 3 USD/JPY

- 4 EUR/CHF

- 5 USD/CAD

- 6 Oil

- 7 Gold

- 8 Interest rates

- 9 Final words

Here I will present my forecast for currency pairs, oil, gold, and interest rates for the year 2016. I will also review my last year’s forecast numbers for integrity check and comparison. This time, I also do another interesting thing with my forecasts — I am putting money where my mouth is. I will trade my 2016 forecasts — losing if they fail and earning profit if I turn out right. Considering the nature of the forecasts, I will be using binary option In/Out contracts with expiration on December 30, 2016, for this purpose. I will buy the contracts at Binary.com, but it can be done with any broker supporting In/Out option trades.

EUR/USD

My 2015 forecast pointed out two year end levels — conservative (1.1500) and optimistic (1.1000). The currency pair had spent most of the year between these levels and has ended it just below the optimistic level.

For 2016, I expect EUR/USD to remain bearish but with a much weaker momentum, ending the year in 5-cent range around the parity (0.9750–1.0250). Binary.com measured the probability of the currency pair ending 2016 inside that range at less than 10% as of December 31.

PS: Do not forget to vote in our yearly EUR/USD poll if you have an opinion on the pair’s future.

GBP/USD

Even though GBP/USD has endend 2015 inside my forecast range (1.4500â1.5000), the pair had spent most of the year well above the upper boundary. The Bank of England avoided raising rates in 2015, preventing a stable rally for GBP/USD.

I believe that in 2016, GBP/USD will enter a recovery uptrend wave when both US and British central banks raise interest rates. But I do not think that the Forex pair will manage to hold a significant level of growth through the year — I expect it to close the period in a wide range between 1.5500 and 1.6000. The probability of this was at about 12% according to Binary.com option price.

USD/JPY

My overly bullish forecast for 2015 did not play well. Perhaps, because there were not too many

For 2016, I expect the rate difference to kick in and push USD/JPY to the very same limits I predicted a year ago — between 130.00 and 140.00. Same as with EUR/USD, the probability of this event according to Binary.com is very low — less than 10%.

EUR/CHF

Of course, I failed to predict the SNB breakdown so my 2015 forecast could go directly to the trash bucket after January 15. I have also decided not to post any CHF forecasts for 2016 as the Swiss National Bank makes the game unplayable. The chart shows only my previous forecast:

USD/CAD

Instead of trying to predict the whimsical moves of EUR/CHF, I will offer my view of USD/CAD pair this time. It was not present in my 2015 forecast. For 2016, I expect it to stabilize after going higher sometimes

Oil

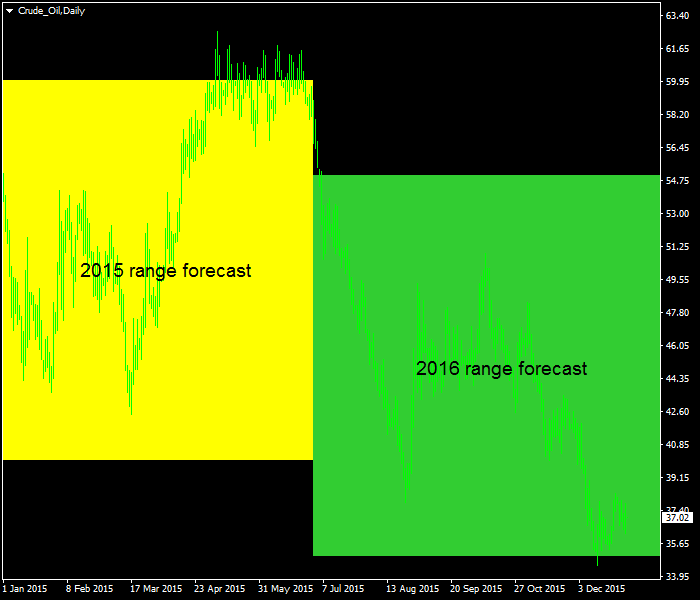

While my call for $40-$60 WTI oil price range in 2015 was not perfect, it has done a good job describing the overall situation in this commodity’s market. The year end price is of course quite below the range. Also,

In 2016, oil should rebound due to decline in supply caused by the lower prices. The $35-$55 range seems like a fairly wide pointer, but it is the best guess I am comfortable with. Unfortunately, there are no binary options available for oil at Binary.com, so this forecast remains unsupported by my own trade.

Gold

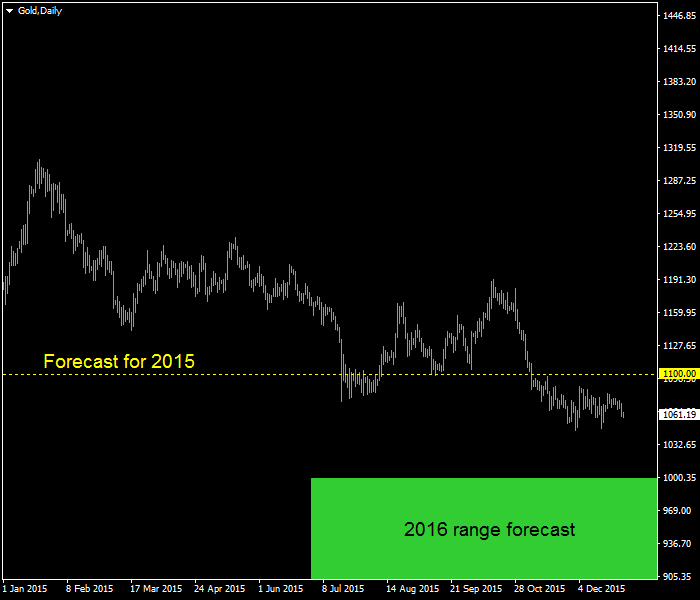

In my 2015 gold forecast, I expected the metal to end the year near $1,100 per ounce after going closer to $1,000 during the period. It was not too far from truth, though, gold has ended 2015 near $1,061 after trading near $1,100 during the year.

I would not be surprised to see gold moving down to the range of $900-$1,000 per troy ounce in 2016. It will only take a few Fed rate hikes. The most probable of all my 2016 forecast bets — Binary.com gauges its veracity at about 15%.

Interest rates

Federal Reserve — I expected no change but we have got a

European Central Bank — ended 2015 right as I expected — with 0.05%. They will keep it unchanged in 2016 too.

Bank of England — did not raise rates in 2015. I predicted a 50/50 chance of raising one time vs. not raising at all. In 2016, they will move the interest rate to the range between 1.00% and 1.25%.

Bank of Japan — did not introduce any surprise for its interest rate in 2015 and I do not expect it to change the rate in 2016.

Bank of Canada — did two unexpected cuts in 2015 (from 1.00% to 0.50%). Still in 2016, I would expect the central bank to begin raising rates when the country’s economy starts improving, ending the year with 0.75% or 1.00%.

Reserve Bank of Australia — Australia cut its rates twice in 2015 too, whereas I expected no change. For 2016, I expect no cut or just one more cut by 0.25% from RBA, meaning that the rate will be 1.75%-2.00% by the year’s end.

Reserve Bank of New Zealand — cut rates four times by 0.25% to the current value of 2.50% while my forecast pointed at a single cut by 0.25%. In 2016, they will probably have to reduce their official cash rate one more time to 2.25%.

Swiss National Bank — moved its rate to -0.75% while I expected -0.25% to hold through 2015. I do not think that SNB actions can be accurately predicted at this point, but I guess they will end 2016 with about -1.00% average interest rate.

Final words

My five binary options that reflect the forecasts in Forex pairs and gold:

Binary.com

That is all for my 2016 Forex forecast. Happy New Year! Keep your trading account safe and hit a lot of high R/R trades in 2016!

If you want to share your own forecast for 2016 regarding Forex and the related markets, please feel free to reply using the form below.