- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 4, 2016

January 4

January 42016

EUR/USD Goes Down During Monday’s Trade

EUR/USD moved lower during the Monday’s trading session, erasing the intraday gains, even though economic reports from the United States were underwhelming. The likely reason for such behavior was risk aversion that hit the Forex market. The main theme today was the negative data from China that scared investors and drove them to safer currencies like the dollar, the yen and the Swiss franc. Final Markit manufacturing PMI dropped […]

Read more January 4

January 42016

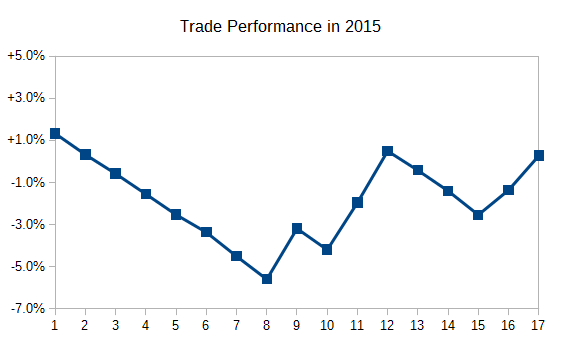

2015 Trading Results Poll

All my 2015 trades are already closed and there is no pending orders carried over into 2016, so it is time to draw a line to look at where I end another year of trading. My profitability in 2015 was way worse than in 2014. 0.2% gain is nothing to be proud of, yet it is not a loss either. In 2015, I have made 17 trades vs. 11 trades […]

Read more January 4

January 42016

Loonie Drops, Even with Higher Oil Prices

Canadian dollar is heading lower today, despite the fact that oil prices are finally on the rise again. With so much risk aversion, the loonie is down in large part due to a desire to shore up with safe haven currencies as the markets struggle. Loonie has been struggling in recent months as oil prices steadily decline. With global oil production outpacing demand, prices have dropped, impacting […]

Read more January 4

January 42016

Euro Struggles as Stocks Drop on Risk Aversion

Euro is struggling today as risk aversion sets in. Stocks are plunging in the wake of the latest Chinese data and that is bringing down high beta currencies like the euro in Forex trading. The latest manufacturing data out of China was disappointing, causing the stock market to drop dramatically. In fact, the drop was so dramatic that China suspended trading, as a new system to trigger trade halts was put into […]

Read more January 4

January 42016

Great Britain Pound Holds onto Gains vs. Dollar, Lower vs. Yen

The Great Britain pound lost some of its gains against the US dollar today, though not all of them, after the UK manufacturing index came out lower than market expectations. The sterling was falling against other major peers, including the Japanese yen. The Markit/CIPS UK Manufacturing PMI ticked lower from 52.5 in November to 51.9 in December compared to the median forecast of 52.8. Other economic indicators released during […]

Read more January 4

January 42016

Year Starts with Risk Aversion, Yen Profits

The year has started with the risk aversion theme that should have been helping the currencies that are traditionally considered to be safe, like the Japanese yen and the Swiss franc. And while the franc is struggling, the yen did indeed was rising. The major piece of news today was the continuing deterioration of the Chinese manufacturing sector. The Caixin China General Manufacturing PMI fell from 48.6 in November to 48.2 in December, indicating […]

Read more