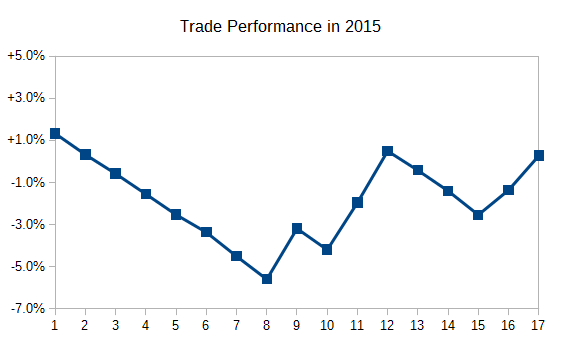

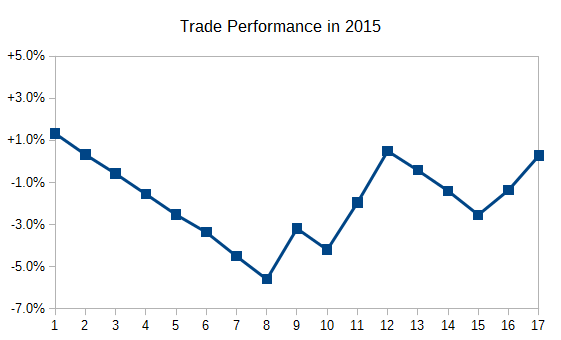

All my 2015 trades are already closed and there is no pending orders carried over into 2016, so it is time to draw a line to look at where I end another year of trading. My profitability in 2015 was way worse than in 2014. 0.2% gain is nothing to be proud of, yet it is not a loss either. In 2015, I have made 17 trades vs. 11 trades in 2014. That brings me to 0.012% profitability per trade. Looks even more dismal, right? But not everything is bad about my last year’s trading results.

Top 3 Trades

What trades have brought me to the positive territory despite a lot of losses? I will sort them according to the reward I took divided by the initial risk (R).

Do you notice the coincidence here? You are right but to a certain extent. Yes, the ascending channels seem like a pure gold. However, you have to consider that 9 out of my 17 trades in 2015 were channels (ascending + descending) and only 5 of those channels were profitable. Which still looks good, of course, but is not as impressive.

Worst 3 Trades

I will apply a similar approach measuring the worst trades too. The good thing about the losing trades is that they rarely deviate from 1R loss.

As you can see, the losses are a mixed bag, which just proves the fact that no matter how hard you try, some trades will end up in red.

Other Trades

The 17 trades discussed above are my main strategy trades that are based on technical analysis patterns and have rather strict rules of entry and exit. In addition to my main strategy, I sometimes engage in trading based on completely different factors — fundamentals, hedging, sentiment analysis, rumors, whatever. This year, there were three such trades that are not included into the performance results mentioned above:

The lesson here is that some

![]() Loading …

Loading …

If you want to share some more information about your Forex trading results for 2015, please feel free to post a comment using the form below.