The

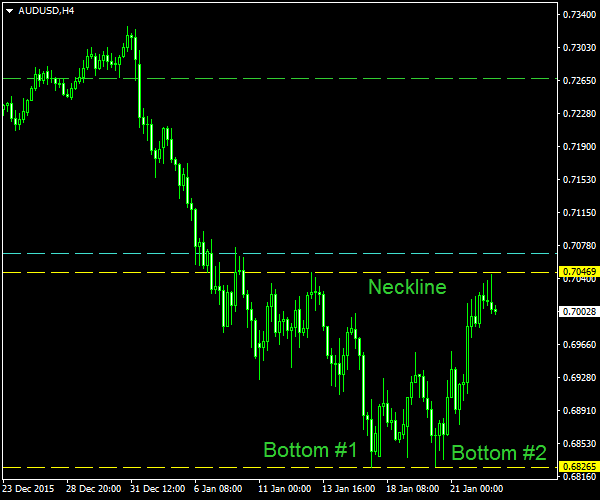

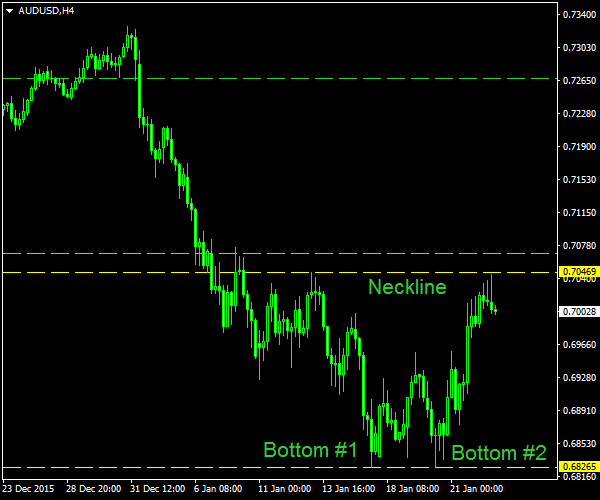

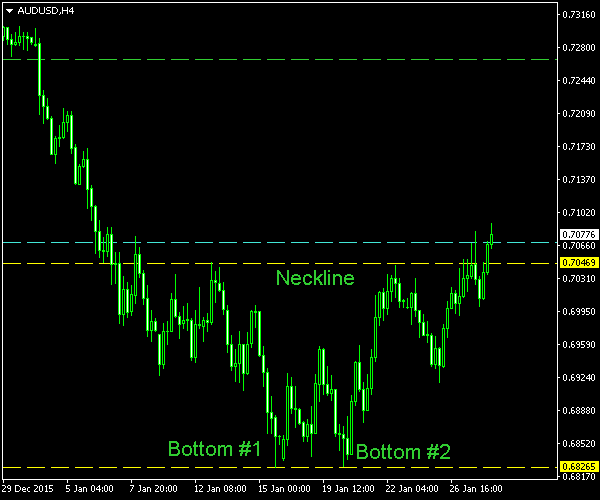

The yellow lines mark the neckline (upper) and the bottoms (lower). The cyan line is my potential breakout entry located at 10% of the pattern’s height (H) above the upper border. The green line is my potential

I have built this chart using the ChannelPattern script. You can download my MetaTrader 4 chart template for this AUD/USD pattern. You can trade it using my free Chart Pattern Helper EA.

Update 2016-01-27 18:04 GMT: I thought this one was going to be cancelled, but the breakout has finally occurred. The buy trade triggered at 16:34 GMT today at 0.70707.

Update 2016-01-28: The

If you have any questions or comments regarding this double bottom on AUD/USD chart, please feel free to submit them via the form below.