- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 14, 2016

March 14

March 142016

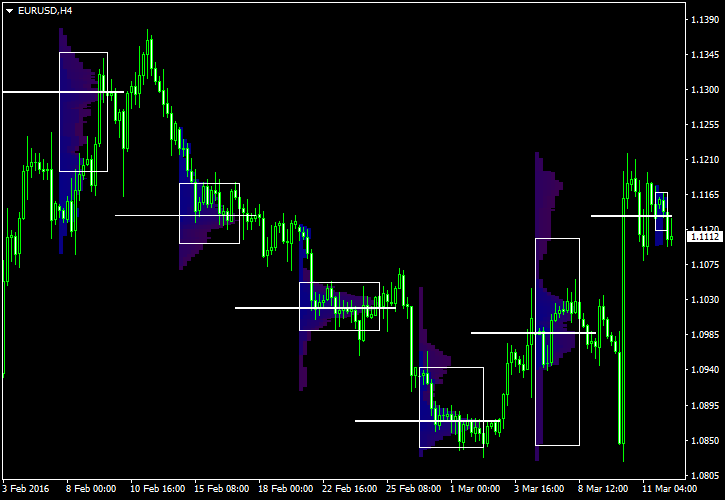

How to Use Market Profile in Forex Trading?

Market Profile indicator is a powerful tool developed by a CBOT trader. Its original purpose was to graphically organize price and time information obtained during a trading session in a manner useful to traders. Today’s Forex market is quite different from what commodity futures trading was back in 1985 when Peter Steidlmayer introduced his charting instrument to the public. Can Market Profile be a useful tool to Forex traders? […]

Read more March 14

March 142016

NZ Dollar Follows Australian Peer in Decline

The New Zealand dollar followed its Australian peer in decline today as the market sentiment was not particularly good for currencies associated with higher risk. Risk aversion caused by mixed economic data released from China over the weekend pushed the kiwi lower, the same as the Aussie. Additionally, last week’s surprise interest rate cut from the Reserve Bank of New Zealand continues to weigh on the currency. It will be interesting […]

Read more March 14

March 142016

Australian Dollar Trades Lower

The Australian dollar traded lower against the US dollar and the Japanese yen today after risk aversion hit the market following the release of mixed macroeconomic data from China over the weekend. China’s industrial production rose 5.4% in January and February from a year ago, slower than the analysts’ prediction of 5.6%. Fixed investment was up 10.2%, beating the forecast of 9.5%. Retail sales also grew 10.2%, yet this indicator […]

Read more March 14

March 142016

Greenback Mostly Higher Ahead of Data

US dollar is mostly higher today, thanks to a certain level of risk aversion. Stocks are struggling and there are concerns about the economies in China and the eurozone. Economic data for the United States is expected throughout this week, and some Forex traders are waiting to see what it shows. Greenback is getting a bump against its high beta counterparts in Forex trading today. There is a lot of […]

Read more March 14

March 142016

Yen Higher on Safe Haven Demand, More Stimulus Could Come

Japanese yen is higher today, thanks in large part to safe haven demand. However, this may not last. The Bank of Japan is expected to continue stimulus in April. Yen is higher against most of its counterparts today. A great deal of uncertainty is causing demand for safe haven assets. Stocks are lower and concerns about the economies around the world are weighing on high beta currencies. As a result, that […]

Read more