- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 17, 2016

March 17

March 172016

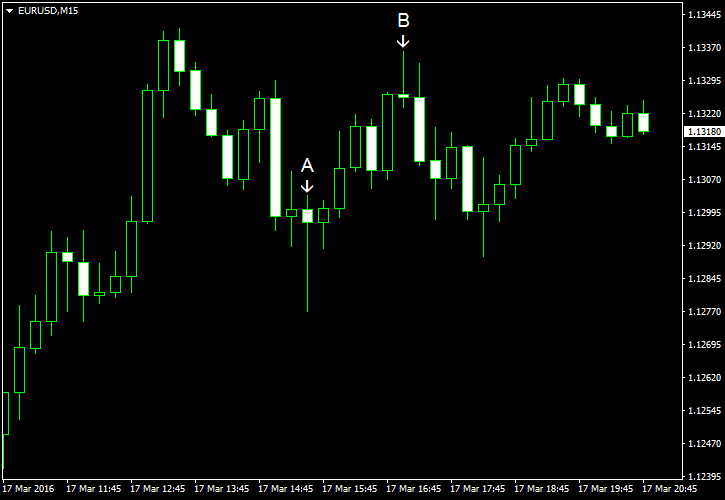

EUR/USD Surges for Second Day

EUR/USD demonstrated a strong rally today, surging for the second day. The dollar remained very weak as an aftershock after yesterday’s policy announcement from the Federal Reserve. As for US economic data, the manufacturing sector staged unexpected revival but other indicators were not especially good. Philadelphia Fed manufacturing index rose sharply from -2.8 in February to 12.4 in March. It was a far better reading than the predicted -1.4. (Event […]

Read more March 17

March 172016

UK Pound Higher, Even After Productivity Forecast Downgrade

UK pound is mostly higher today against its major counterparts, even after the Office for Budget Responsibility (OBR) cut its forecasts for productivity. However, many analysts expect that pounds to weaken in upcoming weeks and months as the Bank of England waits to raise rates until after the Brexit issue is resolved. The OBR revised its workforce productivity forecasts down to 2.0% from an earlier 2.4%. This revision comes […]

Read more March 17

March 172016

Norwegian Krone Rises, Ignoring Interest Rate Cut

The Norges Bank was yet another central bank to hold policy meeting today. The bank made a decision to cut its key interest rate. Surprisingly enough, the Norwegian krone gained against its major peers despite the news. Norway’s central bank held a policy meeting today, but unlike the Swiss National Bank it made changes to its policy. Namely, the bank cut its main interest rate by 25 […]

Read more March 17

March 172016

Swiss Franc Mixed After SNB Refrains from Lowering Rates Further

Quite a few central banks scheduled their policy for the current trading session, and the Swiss National Bank was among them. The bank refrained from changing its monetary policy. The Swiss franc was mixed after the announcement, rising against the US dollar but falling versus the euro. The SNB left its interest rates stable, refraining from lowering them deeper into the negative territory. The central bank signaled that […]

Read more