EUR/USD demonstrated a strong rally today, surging for the second day. The dollar remained very weak as an aftershock after yesterday’s policy announcement from the Federal Reserve. As for US economic data, the manufacturing sector staged unexpected revival but other indicators were not especially good.

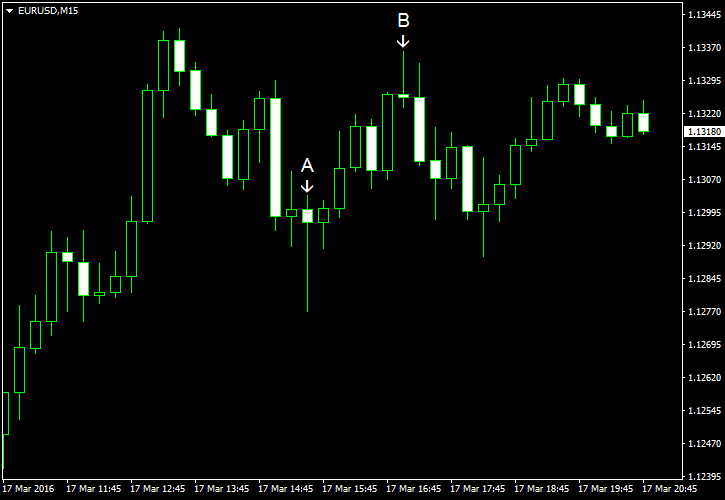

Philadelphia Fed manufacturing index rose sharply from -2.8 in February to 12.4 in March. It was a far better reading than the predicted -1.4. (Event A on the chart.)

Initial jobless claims were at 265k last week (seasonally adjusted). That is compared to the forecast rate of 267k and the previous week’s level of 258k. (Event A on the chart.)

Current account deficit decreased to $125.3 billion in the fourth quarter of 2015 from $129.9 billion (revised) in the third quarter. Forecasters pointed at $117.0 billion as a possible value. (Event A on the chart.)

Leading indicators rose 0.1% in February after falling 0.2% in January. Analysts had predicted a bit bigger growth by 0.2%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.