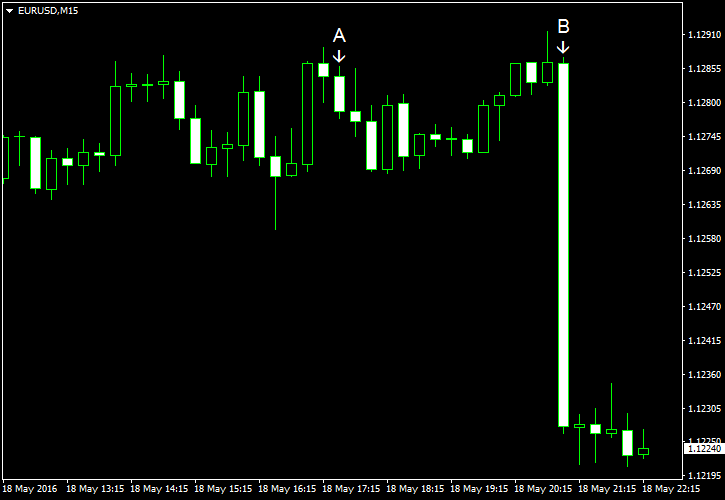

EUR/USD was moving sideways for two days but started to break down today. The decline intensified sharply after the minutes of the latest Federal Reserve meeting proved to be sufficiently hawkish to revive speculations about an interest rate hike in June.

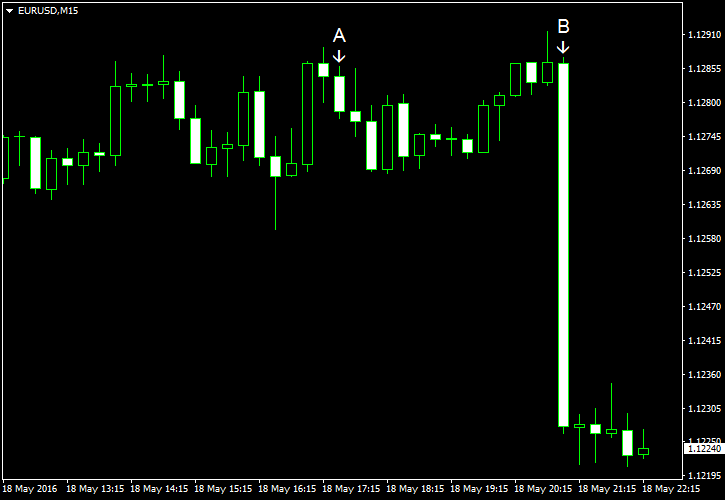

Crude oil inventories rose 1.3 million barrels last week, staying at the historic high level for this time of year. Analysts completely missed with their forecasts of a drop by 3.1 million. The stockpiles were down 3.4 million the week before. Total motor gasoline inventories fell by 2.5 million barrels but were well above the upper range of the average range. (Event A on the chart.)

FOMC released minutes of its April meeting. (Event B on the chart.) The notes showed that a rate increase in June remains possible:

Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee’s 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June.

Moreover, some policy makers complained that the markets have not assessed the probability of a June

Some participants were concerned that market participants may not have properly assessed the likelihood of an increase in the target range at the June meeting, and they emphasized the importance of communicating clearly over the intermeeting period how the Committee intends to respond to economic and financial developments.

If you have any comments on the recent EUR/USD action, please reply using the form below.