Many think of bitcoin as an investment and rightly so, it has grown from being worth fractions of a penny to being worth hundreds of dollars in a few short years. Price fluctuations have made it a popular commodity to trade both in the futures market and in real time. Bitcoin now easily surpasses $100 million in daily trading volume on a regular basis. This type of volume has driven a large need for liquidity in the market — essentially, bitcoin loaned to a margin account so that active traders can increase the size of their positions. If you do not want to engage in speculative trading using bitcoin. Many popular exchanges now let their users offer

Contents

-

1 Poloniex

- 1.1 Getting Started

- 1.2 Loan Duration and Rate

- 1.3 Risks

-

2 Bitfinex

- 2.1 Getting Started

- 2.2 Lending Options

- 2.3 Risks

-

3 OKCoin

- 3.1 Getting Started

- 3.2 Lending Options

- 3.3 Risks

-

4 Automating the Process with Bots

-

4.1 Poloniex Lending Bot

- 4.1.1 How It Works

- 4.1.2 Future Development

- 4.1.3 Risks

- 4.1.4 Free Alternative

-

4.2 Bitfinex Lending Bot

- 4.2.1 Basic Information

- 4.2.2 How to Use It

-

-

5 Expected Returns from Margin Lending

- 5.1 Shop Around for Better Yields

In this tutorial, you will learn how to loan bitcoin out to margin traders on some of the more popular exchanges. You will see the actual

Poloniex

Poloniex is a USA based cryptocurrency trading exchange that is now home to a large amount of volume. Volume is key to putting your bitcoin to work for you. The more trading people want to do the more likely they are to borrow your funds to do so. Poloniex has the volume to keep your bitcoin actively loaned and earning interest.

Getting Started

To begin earning interest on Poloniex, click the orange box on the homepage to create your account. Poloniex asks for your first and last name, your country of residence, an optional phone number, email, and password of your choice. The verification process is then completed by checking your email and following the verification link sent to you by Poloniex.

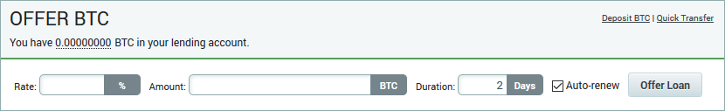

From the homepage, choose the Lending tab at the top of the page, to the right of the Poloniex logo. From there you can deposit bitcoin and get started loaning. Look at the top right of the Offer BTC box near the top of the page. In the upper right corner, there is a link to deposit bitcoin:

Loans have an

If loan interest rates jump up during the course of the previous loan, you do not want to offer the same lower interest rate as you did previously. Instead, you will want to manually

If interest rates drop, then the borrower will likely decline to renew the loan to take advantage of the new lower rates, leaving your bitcoin unused and not earning for you. You will want to manually

The

Loan Duration and Rate

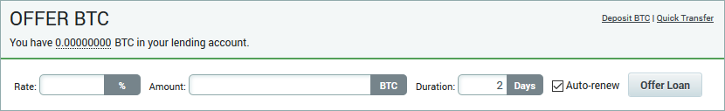

The typical loan on Poloniex is

Typically, the daily interest rate your bitcoin can earn on Poloniex moves from 0.01% to 0.2%. This rate can move to either extreme within a day or two if there is a large spike in buying or selling. Remember that price drop is also a time when margin accounts will be active due to traders attempting to buy the dip or average down on their positions.

Poloniex takes a fee of 15% of your earned interest from each loan completed. This is done automatically at the completion of each loan before your loan and interest are returned to you.

On the Lending page, all the current loan offers are displayed by their interest rate, amount, and duration. This is pictured below. You can use these rates as a benchmark for setting your own. Your aim should be to keep your loans offered at a very competitive interest rate.

When you have made all the decisions about your loan amount, rate, and

Risks

Poloniex relies on margin calls to keep risks at a bare minimum. Leveraged traders are the people you are lending to. They are asking to borrow money so they can increase the size of their positions. On Poloniex, margin traders can borrow up to 2.5 times the amount they have in their margin account (i.e., 1:2.5 leverage). A margin call is done if the margin position loses more than the amount the borrower is using as collateral. If a margin call occurs, Poloniex closes the position and returns your loaned out funds. A margin call is triggered automatically to ensure that no position goes beyond what the borrower has as collateral. This is a good safeguard, but if your borrower suffers a big loss very quickly, it is possible that the margin call will not occur quickly enough to recuperate the entirety of your loan. In the event of this happening, you will lose the interest accrued on the loan and whatever amount of principal that could not be recovered by the margin call. While not likely, this can occur due to the volatile nature of bitcoin’s price.

Poloniex has a great reputation currently in the trading community because the platform they use is effective at mitigating risks. This is not to say that this is entirely

Bitfinex

Bitfinex is one of the most established exchanges running today. It is composed of two legal entities — BFXNA Inc. and iFinex Inc. Both are registered in British Virgin Islands and operating from Hong Kong. It has a stellar reputation and lots of volume.

Getting Started

Setting up an account with Bitfinex is simple. You will be asked for a username, email address, and password of your choice. Enter this information, verify your account by following the link in the email Bitfinex sends, and then your account will become activated.

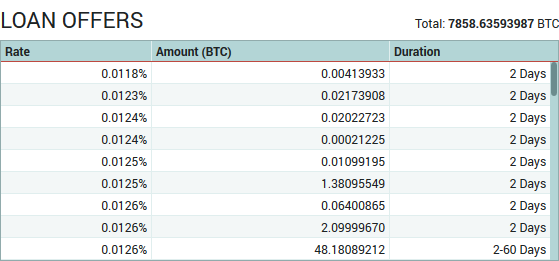

Once you have logged into your account, the homepage can be used to deposit bitcoin. The link is at the

Bitfinex accepts deposits in bitcoin and in USD by bank wire transfer. Bitcoin is preferable because it avoids the hassle and fees associated with a bank wire. Bitfinex requires a minimum of $50 to offer margin lending (called Margin Funding in this exchange), so make sure you deposit at least that amount in bitcoin. Send your bitcoin to the margin wallet address as pictured below. Margin funding is done directly out of your deposit wallet so it is right where it needs to be once deposited.

Lending Options

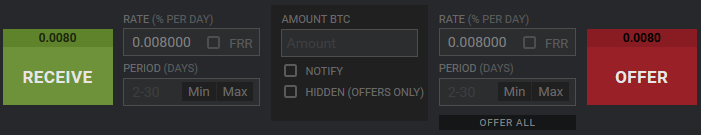

On the Bitfinex homepage, choose the Margin Funding tab to the right of the logo. This will display the margin funding page:

Select the currency you are lending — in this case, BTC. Then fill out the fields near Offer button. Here you can enter the length, daily interest rate, and amount of the loan you wish to offer.

You can take advantage of the Bitfinex Flash Return Rate (FRR) to help automate your loans.

If you turn FRR on, Bitfinex will automatically assign your loan an interest rate based on the average of the total fixed rate positions, weighted by the size of the loan and terms. FRR is not the optimal way to make money, as it will sometimes lead to your loan being offered at a rate that is not competitive enough. Letting your loan sit idle and not earning interest will cost you a lot of returns in the long run.

To keep yourself informed about your loans, you can set up notifications. To do this, simply toggle notify all using a button next to your loans. You will now be informed when a loan expires and is put back in the offer pool. You can then check the interest rate the FRR assigned to it and make sure you are happy with it. If not, simply change it manually.

Rates on Bitfinex can move rapidly between 0.01% and 0.2% daily interest. It is in your best interest to keep a close eye on your loans to make sure they are competitive at all times.

Once you have set up the loan to your liking, hit the red Offer button. Your loan will then enter the lending pool and will be automatically assigned to a borrower who agrees to the terms. You can follow your loans on the Margin Funding page.

Risks

Margin traders are eligible to borrow an amount of 3.35 times their margin balance (1:3.35 leverage). This is important if the market makes a fast significant move against the position traders have taken. It is possible that the margin call will not be fast enough and you will lose both your interest and some of your principal. This does not happen often as Bitfinex will automatically attempt to liquidate a margin trade if it falls to the value of the borrows collateral balance, but with the 3⅓ leverage it can definitely happen. With higher interest rates comes higher risk.

Being hacked or internal issues are also a risk, as with any exchange. Only invest what you can afford to lose.

Update 2016-08-21: On August 2, 2016, Bitfinex has been hacked with a resulting loss of $72 million worth of BTC. The company imposed a 36.067% haircut on all participants. Even thought, the lacking funds have been replaced by the special IOU tokens (BFX), the hack incident has proven that margin lending poses its own significant risks.

OKCoin

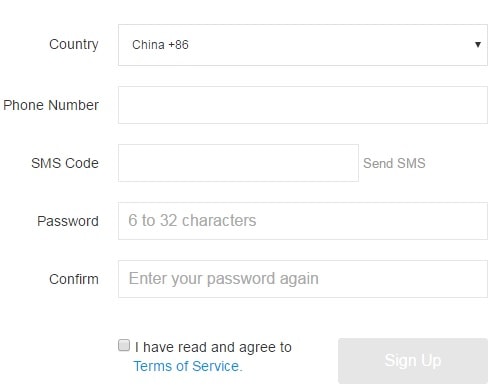

Getting Started

The Signup page for OKCoin is pictured below. To open an account, OKCoin requires you to give them your country of residence, a phone number that can receive an SMS text code, and a password of your choice. Enter your phone number and hit the Send SMS button to the right of the SMS Code box. Once it is sent to you, enter it, check the Terms of Service box, and then hit the Sign Up button.

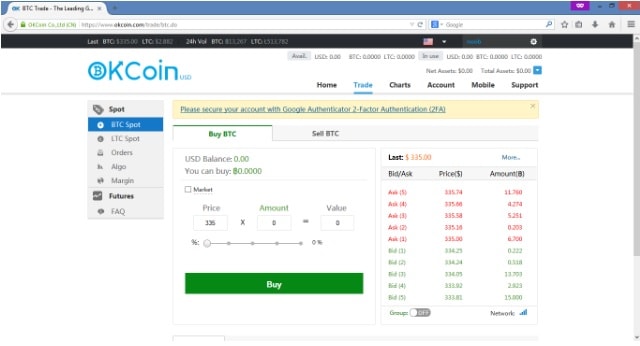

Deposit using the deposit button on the top right of the home page. To start lending, pick the Margin tab on the left side of the homepage, which is pictured below. This will take you to the margin lending page.

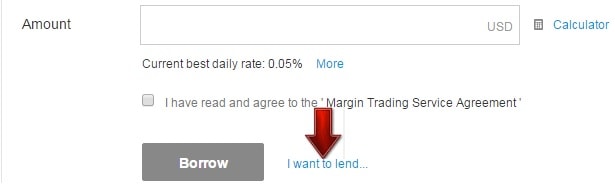

From there, select the I want to lend… link next to the large grey button at the bottom:

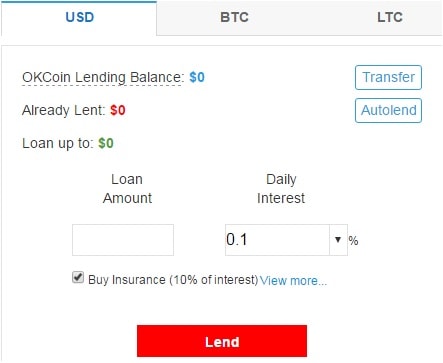

You will need to state that you agree to all terms and conditions. Once this is done, you will be taken to the lending page:

Here you can set the amount you wish to loan and the daily interest you wish to put on it. Once you have set up your loan, you can hit the red Lend button and OKCoin will automatically match your loan up with borrowers.

Lending Options

Margin traders on OKCoin can borrow between 2.2 and 3 times the amount of collateral they have in their margin account (variable leverage between 1:2.2 and 1:3). This is dependent upon the borrowers’ VIP level. Interest is calculated every 24 hours.

Daily interest rates generally hover around 0.1% to 0.15% for bitcoin. These are high rates of return when loaned out continuously and compounded.

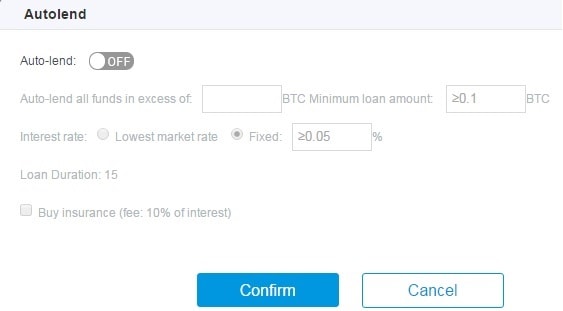

The

Risks

OKCoin offers a unique feature to help mitigate your risk. Insurance is offered at the price of 10% of your interest. OKCoin already charges a fee of 15% of your interest so if you choose this option, you will only keep 75% of the interest you generate on each loan.

Insurance is protection against

Like every exchange, OKCoin is at risk for hacking or internal problems that could result in the loss of all of your funds. Only invest what you can afford to lose.

Automating the Process with Bots

Margin lending bots exist to make the process of earning interest as

Poloniex Lending Bot

Poloniex Lending Bot was built and designed by Ben Roberts. Ben is a

Setting up the Poloniex Lending Bot is easy and is explained

How It Works

The purpose of employing an automated lending bot is to make the process

Poloniex spreads out your loans to dozens or even hundreds of different borrowers. This can be somewhat handled by their

Poloniex Lending Bot charges 10% of any interest earned through any trades the bot participates in. This is in addition to the Poloniex fee of 15% of earned interest on trades. So keep in mind that you will be getting only 75% of your earned interest if you employ the bot.

The service automatically differentiates between loans initiated with the bot and those done manually, so you can continue to do manual loans at the same time you are employing the bot if you choose.

Keeping your bitcoin loaned out as often as possible is crucial to maximizing your returns, so the bot will often pay for itself with it’s ability to get loans out on a constant basis. Remember that the bot only earns the 10% commission on trades it is involved in, so it will be aggressive in placing competitive rates.

The bot does not have access to withdrawals from your account, so in order to pay for the bot you must send in your payment to them. You can deposit bitcoin bot credits to keep the bot active as well.

Future Development

Currently, Ben and his partner are working on adding other exchanges, and letting users have more control over how their funds are deployed. They would like to turn this into a

Risks

In order for the bot to place your loans, it has to have access to your account. This is a real security concern. In order to alleviate these concerns the Poloniex Trade Bot features a security item that limits the abilities it has with your account. The bot is only given restricted API access to your account, disabling both trading and deposit/withdraw options. The restricted access means that the bot’s creators only have access to lending activities and cannot steal your funds.

The Poloniex Lending Bot has handled hundreds of thousands of loans without a single failure. This is the best indicator that the bot works correctly. Most importantly, the bot is not able to take any money from your account. You are responsible for paying for the bot’s services. It will simply be deactivated on your account if you fail to do so. This is specifically designed as a

Using a bot does not alleviate any of the concerns you would have doing business on an exchange in general. There is still a chance of a late margin call due to a sudden crash in bitcoin price, or Poloniex becoming insolvent.

Free Alternative

The actual bot software used by this service is

Bitfinex Lending Bot

Even though Bitfinex has gone through a rather rough period due to its hacking episode, the platform is currently actively used by traders (as of January 2017). It is also suitable for margin lending investment. A number of lending bots are available for Bitfinex. The most

Basic Information

BitfinexLendingBot (or BLB for short) is distributed in form of source code written in Go. This means that you can run BLB on any platform (Linux, Windows, Mac), but you need to compile the source code on that platform. The process is straightforward and is thoroughly explained in the project’s description. The main steps are downloading and installing the Go compiler, downloading the source code files, compiling the code, setting up the API access on your Bitfinex account, configuring and running the BitfinexLendingBot application.

The bot can lend in USD, BTC, ETH, and other cryptocurrencies traded on Bitfinex. It is completely free, but you are encouraged to donate to its author to support further development.

How to Use It

One of the most important steps to use BitfinexLendingBot successfully is setting up API access for it to participate in margin funding with your account. This allows the bot to offer your cryptocurrencies and USD for funding without it being able to trade, exchange, or withdraw funds. After you log into your Bitfinex account, you can create an API key via Account->API link. When you create a new API key, the only permissions you should set are Margin Funding Read & Write and Wallets Read. Make sure to write down the API Key and API Secret values to configure the BLB.

In addition to setting the API key, you can configure the bot’s lending parameters. It is done via the same default.conf and is described in details on the BitfinexLendingBot. The bot can use two strategies:

Running the bot with --updatelends --dryrun keys will test it without actually sending any lending offers to the market.

You can set up either a crontab (on Linux) or Task Scheduler (on Windows) to run the bot every 30 minutes or so.

Using the key --logtofile when running the bot will switch it to write its output into a log file rather than to the screen. This is particularly useful when using BLB in a fully automated mode (and why else do you need a bot?).

Expected Returns from Margin Lending

Interest rates on your margin loans are calculated daily. This is why having your bitcoin loaned out as often as possible is crucial to maximizing your return.

On most exchanges, bitcoin lending rates move in between 0.01% and 0.2% daily interest. Compounded over the course of a year, this can add up to a healthy 10%-15% on your investment. Remember that you will be paying 15% of your earned interest to the exchange when you are trying to calculate your investments.

Right now, the risk is minimal in the markets, but bitcoin is a volatile asset and there is a risk that you could lose your entire investment if the price of bitcoin falls dramatically. As stated before, do not invest more than you can handle losing.

Shop Around for Better Yields

One important step that is often overlooked by the newbie margin funding providers is comparing yield rates between exchanges. While the difference between BTC interest rates may be quite small, the lower volume on altcoins causes the yields to diverge between exchanges. For example, as of May 10, 2017, the gain on ETH at Bitfinex was 0.025% per day — ten times the gain at Poloniex (0.0025%).

However, when choosing a better interest rate for your investment, you have to consider the following factors:

If you have any questions about investing your bitcoin in the safest way possible or if you want to share your own BTC investment strategy (in margin lending or otherwise), please let us know using the commentary form below.