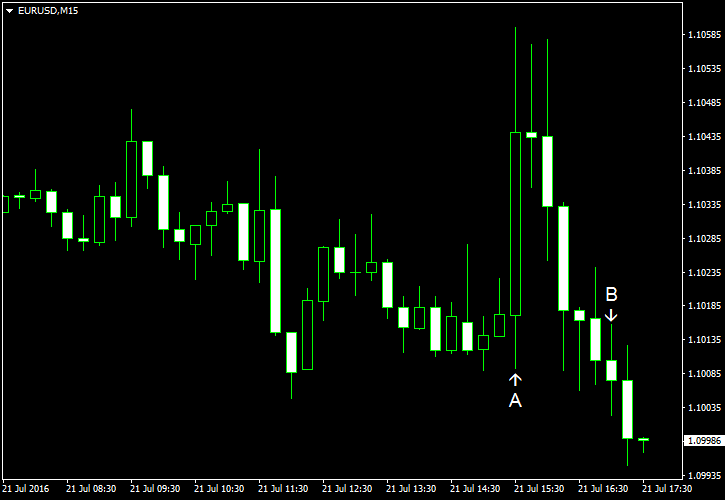

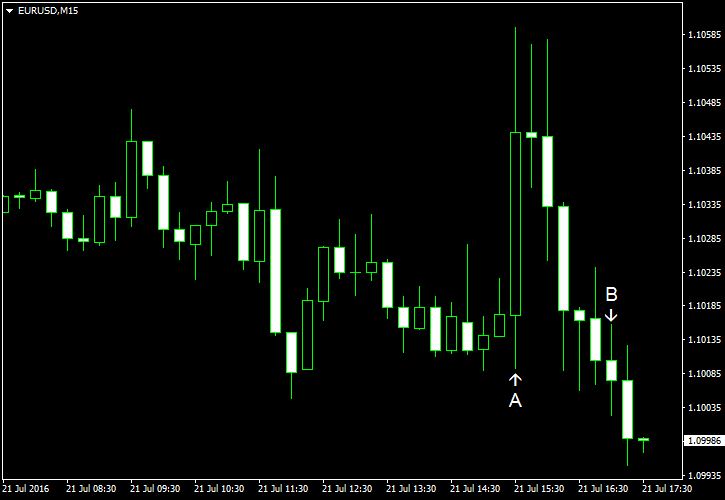

The EUR/USD currency pair was in a slow decline during the most of the trading session today. It had spiked up, attempting to start a rally, following some mediocre fundamental US data, but then quickly returned to its way downwards.

Initial jobless claims went down from 254k to to 253k during the week ending on July 16. The indicator was somewhat better than the 265k forecast expected by the traders. (Event A on the chart.)

Philadelphia Fed manufacturing index unexpectedly declined from 4.7 to -2.9 in July. The median forecast for the index this month was 4.5. (Event A on the chart.)

Existing home sales rose from the seasonally adjusted annual rate of 5.51 million to 5.57 million in June to the positive surprise of the USD bulls who counted on a fall to 5.48 million. (Event B on the chart.)

Leading indicators added 0.3% in June after declining by 0.2% in May. The forecast was pointing at the growth of 0.2% this time. (Event B on the chart.)

Yesterday, a report on the US crude oil inventories has shown a a weekly decrease by 2.3 million barrels following a decline by 2.5 million barrels a week earlier. The drop has outpaced the forecast of 1.3 million barrels decline. Total motor gasoline inventories added 0.9 million barrels during the same time. (Not shown the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.