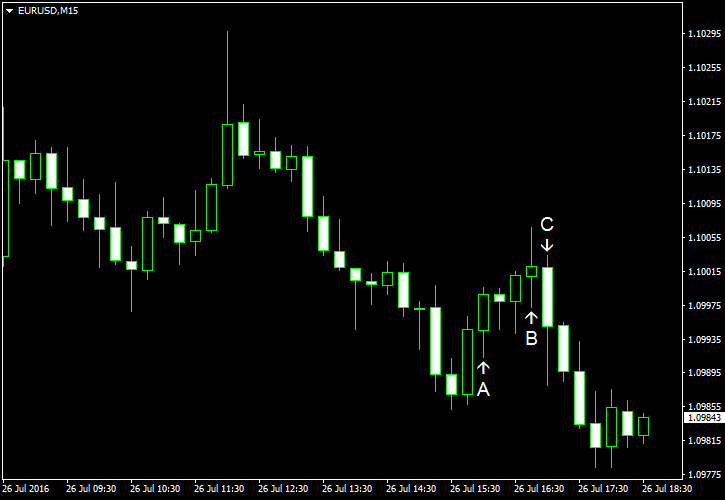

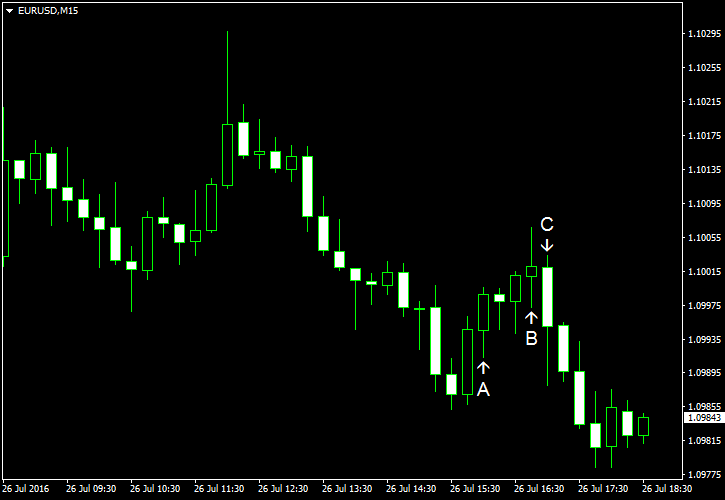

The EUR/USD currency pair has been falling during the day with some minor technical corrections along the way today. The US dollar continued to rise versus the euro following particularly good figures coming out on the US new home sales. The general trend remains pretty clear in EUR/USD these days.

S&P/

Preliminary Markit services PMI for July has shown a decrease from 51.4 to 50.9 while a growth to 52.0 has been forecasted. (Event B on the chart.)

Richmond Fed manufacturing index increased from -10 to 10 in July. A moderate growth to -5 was expected by traders. (Event C on the chart.)

Consumer confidence was at 97.3 in July. It was down just a notch from June’s 97.4 value (revised down from 98.0), but still above the median forecast of 96.0. (Event C on the chart.)

New home sales provided a real positive signal to USD bulls this time — they were at the seasonally adjusted annual rate of 594k units in June vs. 572k reported for May. Moreover, the May’s value has been upwardly revised from 551k. The forecast for this indicator was pointing to 560k. Healthy real estate market in the USA provides a reason for optimism to those expecting higher interest rates from the Federal Reserve this year. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.