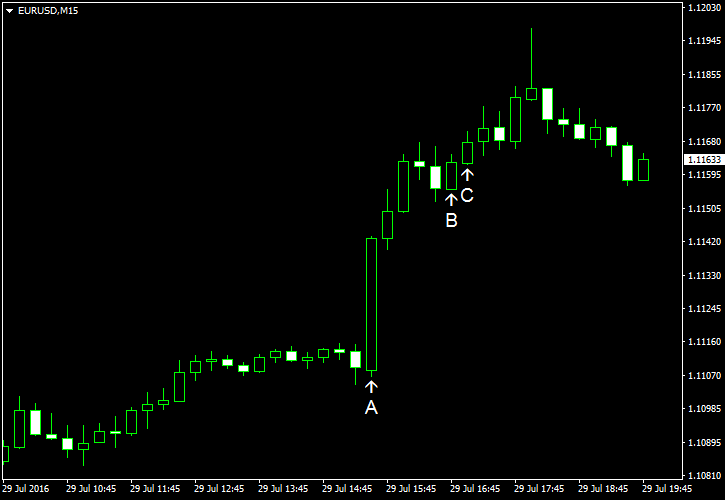

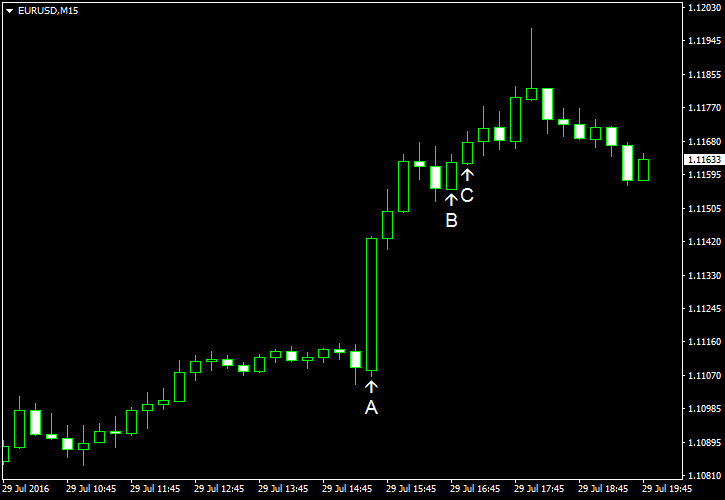

EUR/USD surged up following disastrous US GDP data that will probably prevent the Federal Reserve from raising its target funds rate this year. The currency pair pared some of its gains by now, but still trades significantly above opening level.

US real gross domestic product increased by mere 1.2% in the second quarter of 2016 according to the advance estimate report. The growth followed 0.8% increase in Q1 of 2016 (revised down from 1.1%). The median forecast for Q2 advance estimate was very optimistic — 2.5%. Core PCE inflation was down from 2.1% to 1.7% in the second quarter of this year, in line with the forecasts. (Event A on the chart.)

Chicago PMI decreased from 56.8 to 55.8 in July. It was still better than the forecast of 54.0. (Event B on the chart.)

The final release of the July’s University of Michigan sentiment index has shown an increase from 89.5 to 90 — slightly below forecast of 90.2. (Event C on the chart.)

Yesterday, a report on the initial jobless claims has shown an increase from 252k to 266k during the week ending July 23. Traders expected the value at 262k. (Not shown the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.