- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 8, 2016

September 8

September 82016

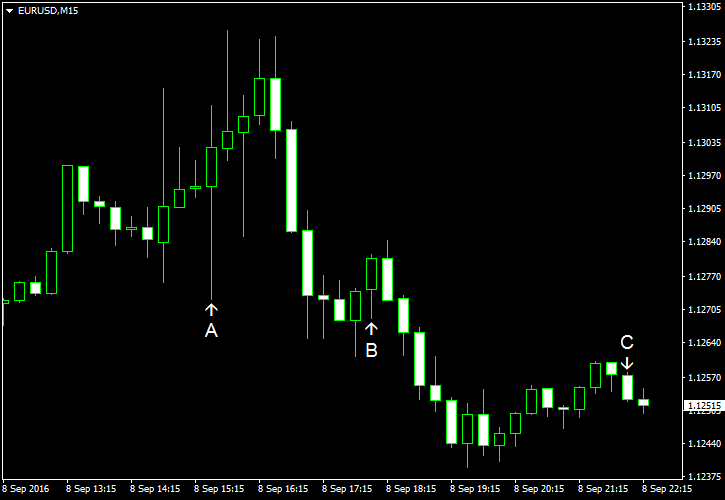

EUR/USD Surges After ECB, Fails to Maintain Rally

EUR/USD surged intraday as the European Central Bank refrained from expanding monetary stimulus. Yet the currency pair retreated to trade below the opening level later as positive macroeconomic data released from the United States and prospects for monetary easing from the ECB were pushing it to the downside. Initial jobless claims were at the seasonally adjusted level of 259k last week while experts had predicted them to stay close to the previous week’s […]

Read more September 8

September 82016

CAD Falls vs. USD & EUR, Beats JPY

The Canadian dollar fell against the US dollar and the euro today as mixed economic data released from Canada was not helping the currency. At the same time, the loonie outperformed the extremely weak Japanese yen. Building permits, released today, showed growth of 0.8% in July, which was far smaller than the analysts’ consensus forecast of 3.2%. Yesterday, the Bank of Canada made a decision to keep interest rates stable. Now, traders wait […]

Read more September 8

September 82016

Euro Climbs as ECB Remains Passive but Struggles to Keep Gains

The euro climbed against its major rivals after the European Central Bank decided to maintain its monetary policy, leaving it without changes. Currently, the euro trimmed its gains versus the Great Britain pound and almost lost them against the US dollar but remained firm versus the Japanese yen. The ECB announced that it is leaving its interest rates at the same levels as before, including the main refinancing […]

Read more September 8

September 82016

Yen Little Changed Following Positive Revision of Japan’s GDP

The Japanese yen was little change today as the impact of the positive revision of Japan’s gross domestic product battled with the influence of stimulus expectations. Japanese GDP grew 0.2% in the second quarter of this year. While it was a slowdown from the previous quarter’s 0.7%, the final reading was better than the preliminary one that had showed no change at all. The report was helpful to the yen, but speculations about additional […]

Read more September 8

September 82016

Australian Dollar Higher After Trade Balance Improves

The Australian dollar rose today following yesterday’s drop. The currency gained thanks to the improvement of the nation’s trade balance. The trade balance deficit shrank from A$3.25 billion in June to A$2.41 billion in July. It was a better reading than the predicted A$2.65 billion. This allowed the Aussie to rally against its major peers while yesterday economic data was not as supportive, leading to a drop of the currency. AUD/USD rose from 0.7670 […]

Read more