2016 is done, and it is now time to see how my last year’s forecast compared to the harsh reality of the Forex market. Of course, I shall also make a new forecast for the year 2017.

Contents

- 1 EUR/USD

- 2 GBP/USD

- 3 USD/JPY

- 4 USD/CAD

- 5 USD/CHF

- 6 Gold

- 7 Oil

- 8 Interest rates

EUR/USD

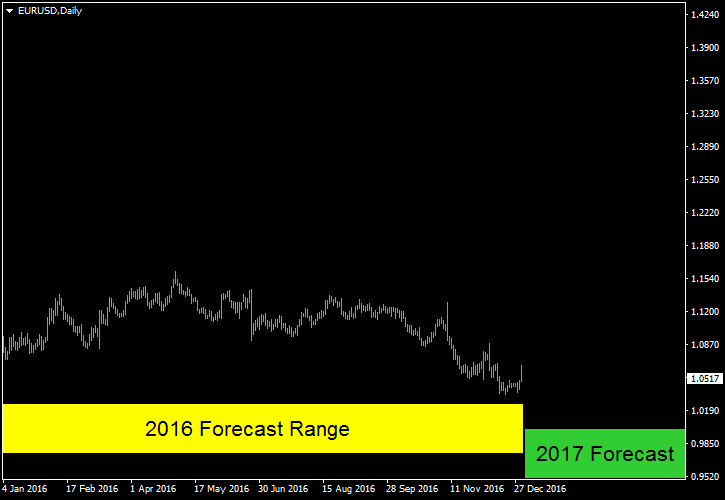

Even though the parity has not been reached in 2016, EUR/USD has ended the year not far from my forecast range (0.9750–1.0250).

What I believe will happen in the new year with EUR/USD is a continued decline in the first half and a consolidation in the second half. The interest rates dynamics in the USA will be supporting the dollar while the ECB’s quantitative easing, which is scheduled to run through the whole 2017, will be undermining the euro’s strength. I expect that USD will start experiencing weakness in the second half of the year as Trump’s economic policies start taking effect. This translates into a sideways market near the 0.9500–1.0000 range, which I project as my

GBP/USD

The error of my GBP/USD forecast is pretty stunning. I am glad I did not sell any put options based on my 2016 predictions. The Brexit was not the only reason for a failure here. The pound has been in a bearish mode even before June referendum. The

Even though I expect the Brexit to continue taking its toll in 2017, I think that the currency pair will end the year in the range of 1.0500–1.1500 (see my GBP/USD parity poll).

USD/JPY

The yen might seem like a weak currency considering its price action since November, but overall, 2016 was a positive year for the Japanese currency. USD/JPY ended the year well below my overly bullish forecast. As I believe that the currencies will be driven by search for safety in 2017, especially in the second half of it, I expect USD/JPY to reverse its bullish trend somewhere around

USD/CAD

Even though USD/CAD has ended 2016 quite above my forecast range, it was approaching the range during the first 3 months of the year and spent a few dozen days inside it. Alas, the bullish trend persisted, letting the pair end the year a thousand pips higher than I would want it to. In 2017, the Canadian dollar will be torn between the oil price rebound, the US economic growth, and a slight probability of revocation or serious reconsideration of NAFTA. High volatility is pretty much guaranteed. My forecast for the yearly close price is between 1.2000 and 1.2500.

USD/CHF

I did not make any forecast for the Swiss franc last year. For 2017, I expect the USD/CHF pair to rise somewhat initially and then to proceed to a free fall. CHF is a largely underappreciated currency considering its appeal as a safe haven. The only constraint for the franc’s growth is its central bank’s tendency to weaken the currency. What I believe might happen this year is the sharp downturn in USD/CHF, with a target range of 0.7300–0.8300 (see my June post on USD future).

Gold

The bearishness of my 2016 forecast for gold was invalidated by how the metal moved during the first half of the year. The second half was all down for gold, but it did not help much. I will not change my forecast for the year 2017. I still expect gold to end the year in the $900-$1,000 range.

Oil

My forecast for the crude turned out to be accurate thanks to its extremely wide range ($35-$55). I am more bullish for 2017 with a forecast range between $60 and $80. My bullishness is based on expectation of a strong worldwide economic growth, which should be helpful to the demand, while the production limits imposed by OPEC and

Interest rates

Federal Reserve — I expected three to four hikes in 2016, but we have seen only one — same as in 2015. This time, I will simply agree with the FOMC’s own median projections — three interest rate hikes in 2017, which means a

European Central Bank — I failed this one too, predicting no change whereas the ECB decreased the rate by 5 basis points to zero. I believe that they will not change the rates in 2017 as they will be reluctant to go into the negative territory while there would not be any point in raising the rates with the quantitative easing active.

Bank of England — failed to move the rates to my last year’s forecast range of 1.00%-1.25%. For 2017, I expect at least one rate cut (to zero) from the BoE.

Bank of Japan — pushed the interest rate down to -0.10% in 2016 while my forecast pointed at no change at 0.10%. I believe that BoJ will not change the interest rate in 2017 and will employ other monetary policy tools to reach its goals.

Bank of Canada — did not raise the interest rate to my forecast value of 0.75% or 1.00%. In 2017, I believe that the bank will have to start increasing the rates due to Canada’s close ties to the USA, which is currently on a rising interest rate curve. So, my last year’s forecast of 0.75%-1.00% still stands.

Reserve Bank of Australia — overshoot my forecast, cutting the rate twice in 2016 instead of only once as I had expected. I think that the interest rate is already at its minimum and that there is a good chance for a rate hike to 1.75% in 2017.

Reserve Bank of New Zealand — I expected only one cut (to 2.25%) whereas the RBNZ reduced the rate to 1.75%. Another rate cut is possible, but at the same time, they might soon start raising the rate. Overall, I forecast the

Swiss National Bank — kept its average rate unchanged at -0.75% through 2016. My prediction was for a single cut that year. For 2017, I forecast no change to the rate as the central bank will continue to assess the effectiveness of its negative rates policy.

Update 2017-01-09: I am investing money in my own forecast by buying

If you want to share your own forecast on Forex or the related markets for 2017, please feel free to reply using the form below.