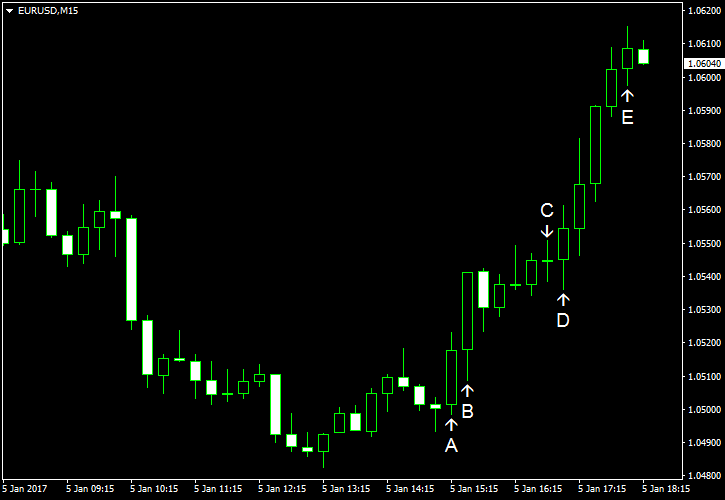

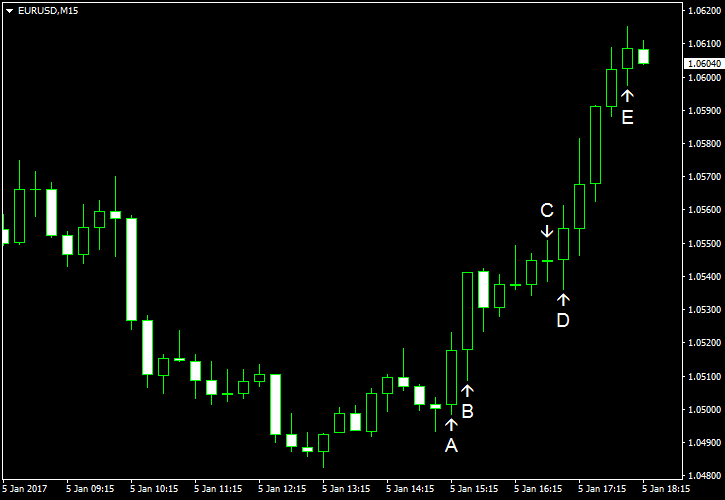

Even though some of the US macroeconomic reports were positive today, the dollar fell against the euro. The decline was triggered by a rather weak ADP employment data.

ADP employment went down from 215k to 153k new jobs in December. Traders had expected a less abrupt drop to 175k. Weak ADP numbers set poor sentiment towards the

Initial jobless claims decreased from 263k to 235k last week. The forecast had been for a 260k value. (Event B on the chart.)

Markit services PMI saw an upward revision from 53.4 to 53.9 in the final report for December compared to its flash estimate released earlier. Market participants had expected the value to remain unchanged. (Event C on the chart.)

ISM services PMI remained at 57.2 in December while the median forecast had pointed at a decline to 56.8. (Event D on the chart.)

US crude oil inventories lost 7.1 million barrels last week after gaining 0.6 million barrels a week earlier. At the same time, total motor gasoline inventories increased by 8.3 million barrels during the last week. (Event E on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.