- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 7, 2017

March 7

March 72017

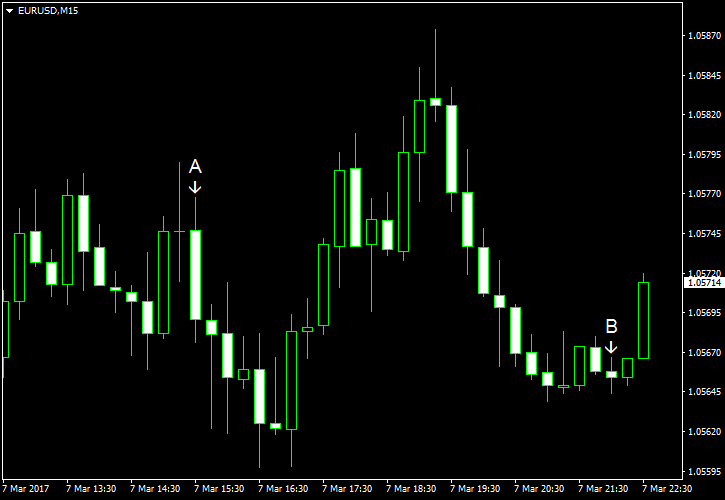

Disappointing US Data Doesn’t Help EUR/USD

Macroeconomic data released from the United States today failed to meet market expectations, but it hardly affected EUR/USD, which fell despite the intraday attempt to bounce. The most likely reasons for the drop were: anticipation of an interest rate hike from the Federal Reserve next week, expectations of decent nonfarm payrolls this week, and renewed concerns about the outcome of the French presidential elections. Trade balance deficit widened to $48.5 billion […]

Read more March 7

March 72017

Canadian Dollar Trades near Lowest Level in Two Months After Trade Data

The Canadian dollar retreated against its US counterpart and other major peers on Tuesday, despite a report that revealed a stronger trade surplus in Canada than expected. The US dollar has been strongly supported this week by higher odds of an interest rate hike from the Federal Reserve. Statistics Canada, the central statistical office of the country, released its report for the international trade balance, which said that Canadian trade surplus […]

Read more March 7

March 72017

Brexit Fears & Poor Macroeconomic Data Drive Pound Down

The Great Britain pound fell today, trading near the lowest level since January 17 versus the US dollar, driven down by Brexit fears and poor macroeconomic reports. British Retail Consortium reported that like-for-like retail sales fell 0.4% in February from a year ago. The Halifax House Price Index was up just 0.1% last month from the previous month versus the 0.4% increase predicted by analysts. Meanwhile, […]

Read more March 7

March 72017

Australian Dollar Welcomes RBA Decision to Stay Pat

The Reserve Bank of Australia maintained its cash rate unchanged during the monetary policy meeting on Tuesday. The Australian dollar reacted positively to the news. Currently, the Aussie trades off the day’s highs but still above the opening level. The RBA left its main interest rate at 1.5%. Such decision was widely anticipated by market participants, providing no surprises. The policy statement had few changes compared to the previous ones, remaining […]

Read more