It is not the aim of this post to explain how the central bank interest rates work. Its aim is to show how the current federal funds rate operation differs from its

Before 2008

Contents

- 1 Before 2008

-

2 Our times

- 2.1 Ceiling rate

- 2.2 Floor rate

- 2.3 Efficiency

- 3 Relation to Forex

When things were simple (before 2008), the Federal Reserve set its target federal funds rate (FFR) as a single number and made sure that the effective federal funds rate (EFFR) is at the target level by performing open market operations (OMO). Those OMO normally included repurchase agreements (repo or RP) to temporarily increase the reserves supply in the federal funds market (FFM) (and thus reduce the demand and the EFFR) and reverse repurchase agreements (RRP) to temporarily decrease the supply of reserves and drive the EFFR up.

It worked very well because the total size of bank reserves was rather small ($15 billion) in

Our times

Nowadays, when the Fed is holding $2.23 trillion in reserve balances (as of June 12, 2017), the old scheme would not fare so well. There is no scarcity of reserve balances at all. To create it, the Fed would need to sell a big share of its securities to shrink the total reserves to manageable size. But that would create some problems — it would drive down the prices of those securities and would launch a series of unpredictable market feedback loops.

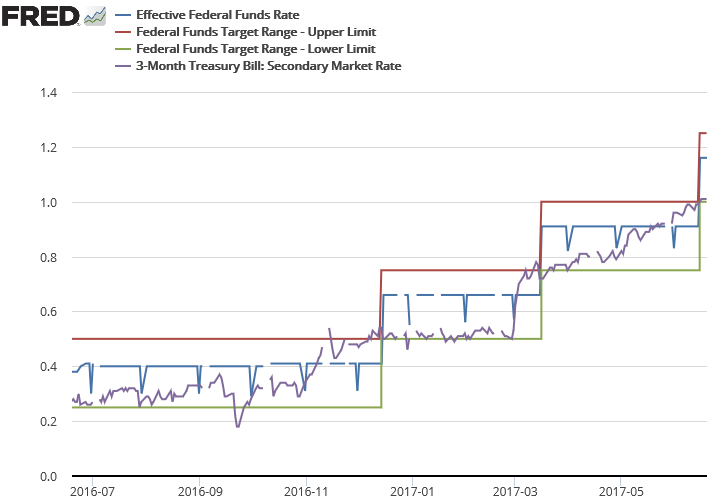

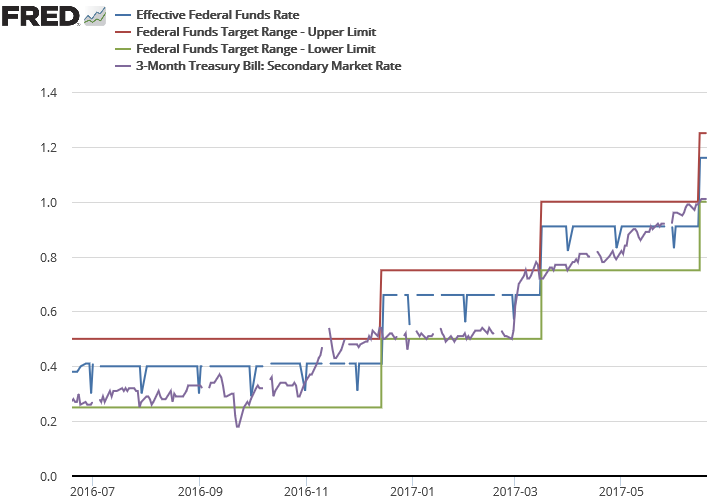

Instead, what the Fed is doing since 2008 is setting a target FFR as a range between two interest rates. For example, it is 1.00%–1.25% as of today while the EFFR, measured as

Ceiling rate

The Fed makes sure that the FFM respects the target bounds by setting the interest on excess reserves (IOER) to the top boundary rate. When 95% of the reserve balances are the excess balances (balances exceeding the required level), the IOER rate paid by the Fed to the banks for holding these reserves serves as the ceiling for the rate corridor. It may sound

The

Floor rate

And how about the floor of the rate range (the 1.00% part of today’s target range)? It is enforced by the Fed through the OMO called overnight repurchase agreement (ON RRP). With it, the Fed can drain some reserves from the system by borrowing cash from market participants, giving them securities as a collateral. Since not only banks can earn interest on their funds with ON RRP (GSEs can also do it), this sets the de facto lower boundary for the EFFR. Who would lend at a lower rate if they can choose to get at least this rate from the

One important feature of the current system is that the EFFR does not cling to the upper side of the rate range (IOER) but hovers below it, falling down to near the ON RRP rate during the final day of the month. The reason for the former is that the banks pay higher FDIC insurance fees when they borrow more. And the reason for the latter is that the banks need to follow the Basel requirements, which limit their leverage, but are calculated based on the

Efficiency

As a result, we can see the EFFR fluctuating between ON RRP and IOER — well within the boundaries of the Fed’s target FFR. The

Relation to Forex

So why should Forex traders care about this? Because effective federal funds rate and the Fed’s ability to uphold it are even more important for the US dollar than the target rate set by the Federal Open Market Committee at its meetings. It is the higher EFFR that would stimulate banks buying more USD to park it either with the Fed or with the GSEs. It is the lower EFFR that would let banks to use the USD as a carry trade short side.

Now you see that any significant news concerning GSE regulations, Basel III requirements, or FDIC insurance fee policies could have tremendous influence on the USD rate based on how such news could affect the EFFR. As a currency trader, you have to be

I recommend the following resources to stay

Of course, you can also use some financial news outlet of your choice that would cover all these topics.

If you have some interesting notion on the way the federal funds rate is currently set by the US Federal Reserve or an opinion on how it can affect retail Forex traders, please use the commentary form below to share your thoughts.