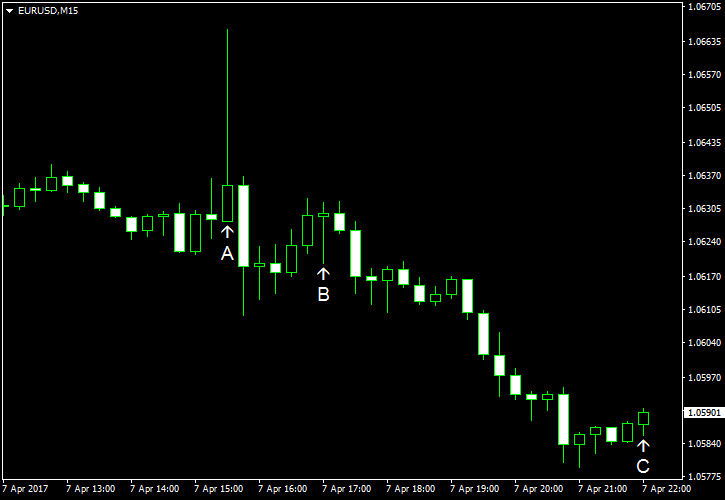

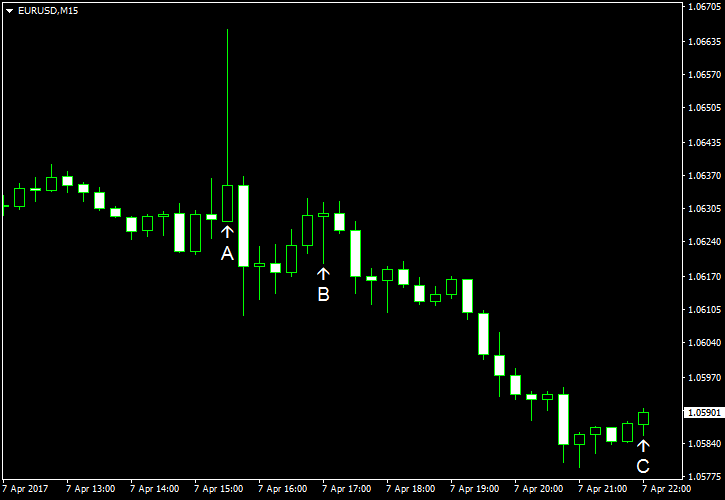

US employment demonstrated very underwhelming growth last month. EUR/USD rallied as a result, though surprisingly, the rally was very

Nonfarm payrolls grew by just 98k in March, a far cry from 174k promised by forecasters. What is more, the February increase was revised down from 235k to 219k. Average hourly earnings rose 0.2%, matching expectations, after increasing 0.3% in the previous month (revised from 0.2%). Unemployment rate fell from 4.7% to 4.5% unexpectedly, reaching the lowest level since May 2007. (Event A on the chart.)

Wholesale inventories expanded by 0.4% in February versus 0.1% predicted by analysts. The stockpiles shrank by 0.1% in January. (Event B on the chart.)

Consumer credit rose by $15.2 billion in February, a bit more than analysts had predicted — $14.2 billion. The previous month’s increase was revised up from $8.8 billion to $10.9 billion. (Event C on the chart.)

Yesterday, a report on initial jobless claims was released, showing a drop from 259k to 234k last week, far below the average forecast of 251k. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.