EUR/USD was falling today and the decline accelerated after US employment showed a very robust growth. Other reports from the United States were either neutral (manufacturing) or bad (jobless claims and construction spending), but it looks like markets focused singularly on the employment data. Hawkish comments from John Williams, President of the San Francisco Federal Reserve Bank, were also driving the currency pair down.

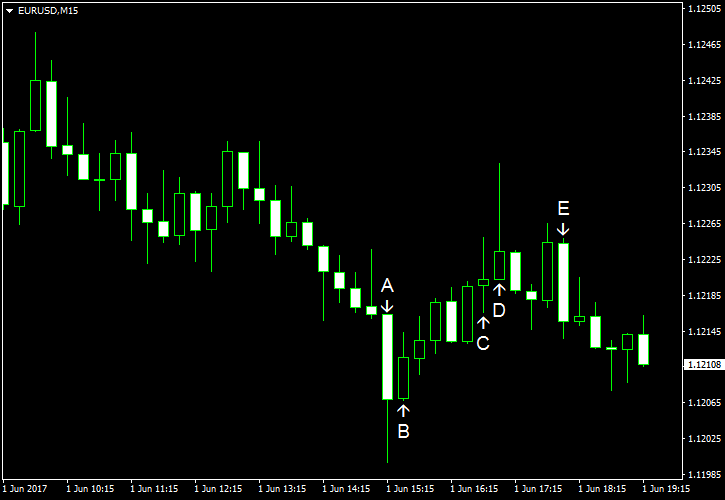

ADP employment jumped by 253k in May, demonstrating a far bigger growth than 181k predicted by analysts and 174k registered in April. (Event A on the chart.)

Initial jobless claim increased from 235k to 248k last week. The actual value exceeded the forecast figure of 239k. (Event B on the chart.)

Final Markit manufacturing PMI was at 52.7 in May, almost unchanged from April’s 52.8. Experts were expecting the same 52.5 reading as in the preliminary estimate. (Event C on the chart.)

ISM manufacturing PMI was at 54.9% in May, close to the April’s reading of 54.8% and the estimate of 54.7% made by analysts. (Event D on the chart.)

Construction spending was down 1.4% in April from March instead of rising by 0.5% as experts had predicted. On a positive note, the March reading got a big positive revision from a drop by 0.2% to a gain of 1.1%. (Event D on the chart.)

Crude oil inventories decreased by 6.4 million barrels last week but were in the upper half of the average range for this time of year. That is compared to the predicted drop of 2.7 million and the previous week’s decline of 4.4 million. Total motor gasoline inventories declined by 2.9 million barrels but were near the upper limit of the average range. (Event E on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.