EUR/USD dropped today due to the rumor that the European Central Bank will lower its inflation forecast at the next policy meeting. The ECB will meet tomorrow, and markets were hoping for a hawkish policy statement after the gathering. Yet if the rumor proves true, the central bank will likely maintain its dovish stance. The currency has bounced by now and is attempting to reverse the decline on the back of the disappointing US consumer credit report, but with limited success so far.

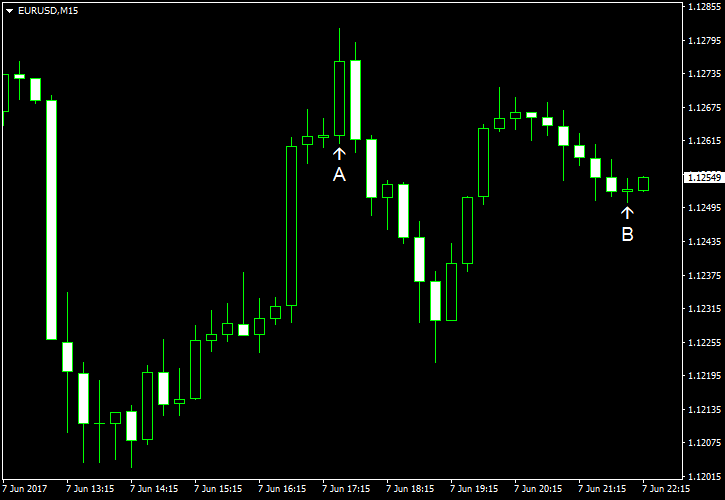

US crude oil inventories rose by 3.3 million barrels last week and were in the upper half of the average range for this time of year. Forecasters were frustrated by the report as they have predicted a drop by 3.1 million barrels. The week before, the stockpiles shrank by 6.4 million. Total motor gasoline inventories also rose by 3.3 million barrels last week and were above the upper limit of the average range. (Event A on the chart.)

Consumer credit rose by just $8.2 billion in April, whereas analysts predicted an increase by at least $15.2 billion. The previous month’s increase was revised from $16.4 billion to $19.6 billion. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.