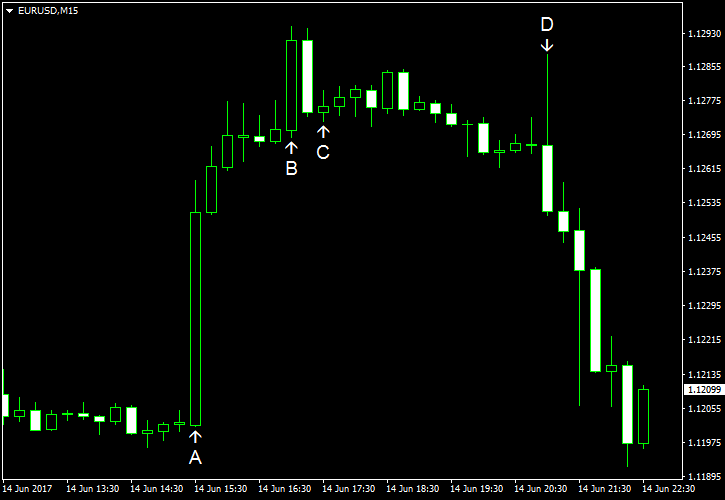

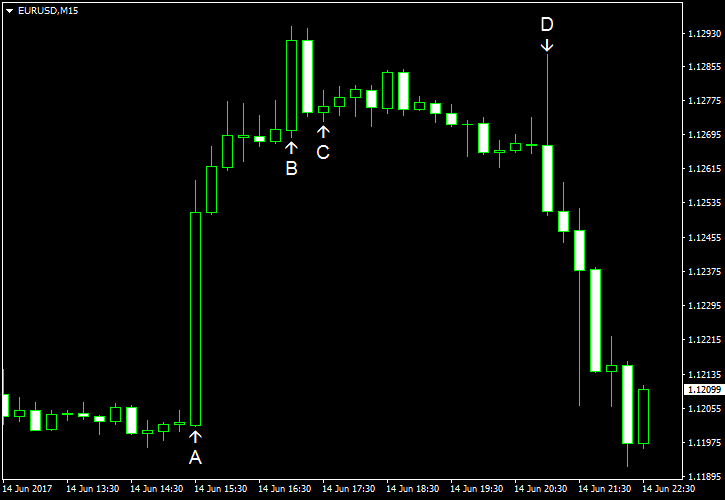

EUR/USD rallied today as data about inflation and retail sales came out unexpectedly bad. The Federal Open Market Committee raised the main interest rate and predicted one more hike in 2017, staying in line with the previous forecasts. Considering that many market participants were expecting FOMC to revise the projected dot path down, the announcement looked very bullish to the dollar. The EUR/USD currency pair halted the rally after the news, though it is unlikely to erase its big gains by the end of the trading session.

CPI fell 0.1% in May on a seasonally adjusted basis. That was a surprise to analysts as they were expecting an increase at the same 0.2% rate as in the previous month. (Event A on the chart.)

Retail sales dropped 0.3% in May (adjusted for seasonal variations). That was also a negative surprise to experts, who were anticipating a 0.1% increase. The index was up 0.4% in April. (Event A on the chart.)

Business inventories fell 0.2% in April. That is compared to the predicted drop by 0.1% and the previous month’s rise by 0.2%. (Event B on the chart.)

US crude oil inventories fell by 1.7 million barrels last week, somewhat less than specialists predicted (2.3 million), but remained in the upper half of the average range for this time of year. The stockpiles rose by 3.3 million the week before. Total motor gasoline inventories rose by 2.1 million barrels last week and were above the upper limit of the average range. (Event C on the chart.)

FOMC concluded its

The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate.

Indeed, FOMC kept the forecast for the projected appropriate policy path unchanged, meaning that one more interest rate hike this year is expected. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.