- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 6, 2017

July 6

July 62017

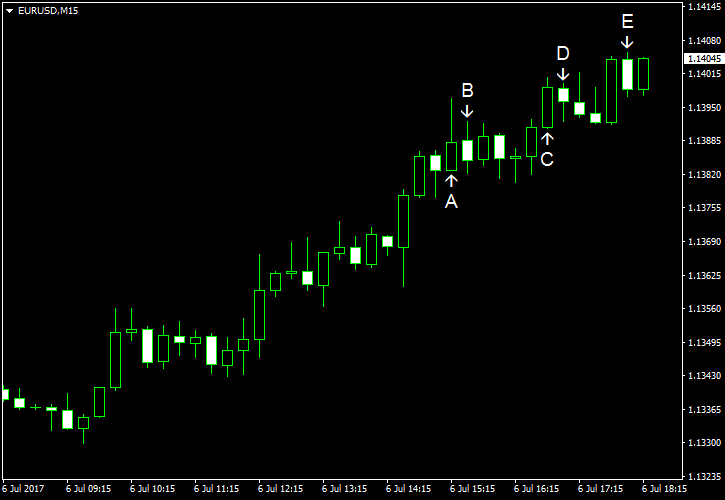

EUR/USD Rallies, Extends Move Up After ADP Employment

EUR/USD was rising today and extended its move up after employment data from Automatic Data Processing missed expectations. The currency pair paused its rise after the US services sector demonstrated strong growth. ADP employment rose by 158k in June, seasonally adjusted, failing to reach the 184k figure promised by analysts. Furthermore, the May growth was revised from 253k to 230k. (Event A on the chart.) Initial jobless claims […]

Read more July 6

July 62017

Positive Fundamentals Fail to Provide Support to Canadian Dollar

The Canadian dollar was flat versus the US dollar and the Japanese yen and fell against the euro and the Swiss franc even though fundamentals should have supported the currency. Prices for crude oil, Canada’s biggest export, jumped more than 2% in New York today. Crude gained as data showed bigger-than-expected draw from US inventories. Canada’s trade deficit rose from C$0.6 billion in April to C$1.1 billion in May. Experts […]

Read more July 6

July 62017

Positive Fundamentals Fail to Provide Support to Canadian Dollar

The Canadian dollar was flat versus the US dollar and the Japanese yen and fell against the euro and the Swiss franc even though fundamentals should have supported the currency. Prices for crude oil, Canada’s biggest export, jumped more than 2% in New York today. Crude gained as data showed bigger-than-expected draw from US inventories. Canada’s trade deficit rose from C$0.6 billion in April to C$1.1 billion in May. Experts […]

Read more July 6

July 62017

US Dollar Plummets Against Major Peers as Employment Data Misses Estimates

The US dollar plummeted against the euro and the British pound on Thursday, following a number of disappointing economic data that further confirmed a slowdown in the US economic growth. The greenback declined despite marginally stronger business activity in the United States, which failed to cancel the negative effect of todayâs economic releases. The ADP Research Institute published a fresh report on nonfarm employment at 12:15 GMT today, which showed that the private sector hired 158,000 […]

Read more July 6

July 62017

US Dollar Plummets Against Major Peers as Employment Data Misses Estimates

The US dollar plummeted against the euro and the British pound on Thursday, following a number of disappointing economic data that further confirmed a slowdown in the US economic growth. The greenback declined despite marginally stronger business activity in the United States, which failed to cancel the negative effect of todayâs economic releases. The ADP Research Institute published a fresh report on nonfarm employment at 12:15 GMT today, which showed that the private sector hired 158,000 […]

Read more July 6

July 62017

Euro Rallies Higher Against US Dollar on Hawkish ECB Minutes

The euro today rallied higher against the US dollar after hawkish comments from the European Central Bank minutes released today. Weak initial jobless claims data from the US docket also contributed to the EUR/USD’s rally as it did not meet market expectations. The currency pair gained over 70 points at the height of its rally reversing most of the losses it had sustained over the past three days. The ECB […]

Read more July 6

July 62017

Euro Rallies Higher Against US Dollar on Hawkish ECB Minutes

The euro today rallied higher against the US dollar after hawkish comments from the European Central Bank minutes released today. Weak initial jobless claims data from the US docket also contributed to the EUR/USD’s rally as it did not meet market expectations. The currency pair gained over 70 points at the height of its rally reversing most of the losses it had sustained over the past three days. The ECB […]

Read more July 6

July 62017

Great Britain Pound Steady, Undeterred by Poor Economic Data

The Great Britain pound was steady today as the recent bout of poor macroeconomic releases did not deter investors from the currency. The Purchasing Mangers’ Indexes for Great Britain released this week were universally disappointing. Yet it looks like they did not prevent market participants from expecting the Bank of England to perform monetary tightening in the not-so-distant future. While the sterling pulled back from the recent highs, it […]

Read more July 6

July 62017

Great Britain Pound Steady, Undeterred by Poor Economic Data

The Great Britain pound was steady today as the recent bout of poor macroeconomic releases did not deter investors from the currency. The Purchasing Mangers’ Indexes for Great Britain released this week were universally disappointing. Yet it looks like they did not prevent market participants from expecting the Bank of England to perform monetary tightening in the not-so-distant future. While the sterling pulled back from the recent highs, it […]

Read more July 6

July 62017

Aussie Flat After Release of Australian Trade Balance

The Australian dollar was little changed today after the release of surprisingly strong trade balance data. Australia’s trade surplus climbed to A$2.47 billion in May, far exceeding the median forecast of A$1.00 billion. The April’s reading was revised from A$0.56 billion to A$0.09 billion. The Australian currency did not profit from the data most likely because of the disappointment that the Reserve Bank of Australia did not turn hawkish, unlike […]

Read more