- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 7, 2017

July 7

July 72017

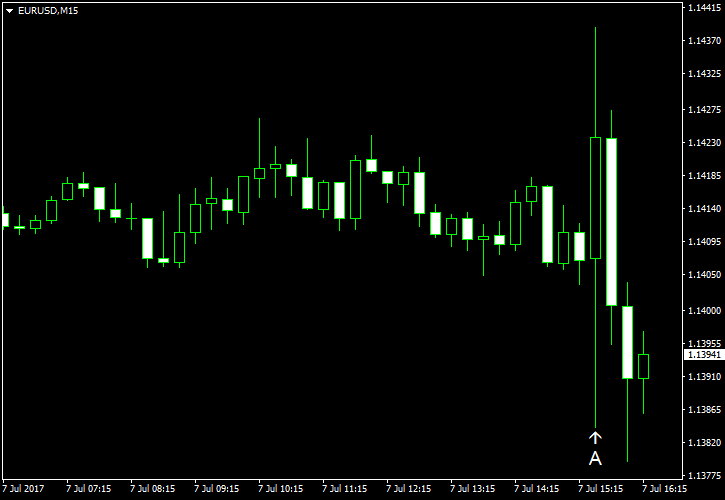

EUR/USD Jumps on NFP, Reverses Gains Immediately

After yesterday’s private employment report missed expectations, economists were concerned that today’s nonfarm payrolls would also be disappointing. Yet that was not the case, at least in terms of employment growth, which turned out to be better than expected. But other parts of the report were not that good, with the unemployment rate demonstrating an unexpected increase and wage inflation stalling. The mixed data led to volatile […]

Read more July 7

July 72017

US Dollar Rallies Higher Against Peers on Positive Non-Farm Payrolls

The US dollar today rallied higher against its main peers such as the euro, the British pound and the Japanese yen as the non-farm payrolls report beat expectations. The US dollar rallied higher against its peers today building on the momentum established yesterday after the release of positive ADP national employment report. The US Dollar Index, which tracks the greenback’s performance against a basket of its main peers, was trading above its […]

Read more July 7

July 72017

US Dollar Rallies Higher Against Peers on Positive Non-Farm Payrolls

The US dollar today rallied higher against its main peers such as the euro, the British pound and the Japanese yen as the non-farm payrolls report beat expectations. The US dollar rallied higher against its peers today building on the momentum established yesterday after the release of positive ADP national employment report. The US Dollar Index, which tracks the greenback’s performance against a basket of its main peers, was trading above its […]

Read more July 7

July 72017

Employment Data Fuels Rally of Canadian Dollar

The Canadian dollar jumped today, rising more than 1% against some of its most-traded rivals, after the release of a better-than-expected employment report. Canadian employers added 45,300 jobs in June. That was much more than analysts had predicted (11,400) and close to the previous month’s strong gain of 54,500. The unemployment rate unexpectedly fell from 6.6% to 6.5%. The Ivey Purchasing Managers Index did not disappoint as well, climbing […]

Read more July 7

July 72017

Employment Data Fuels Rally of Canadian Dollar

The Canadian dollar jumped today, rising more than 1% against some of its most-traded rivals, after the release of a better-than-expected employment report. Canadian employers added 45,300 jobs in June. That was much more than analysts had predicted (11,400) and close to the previous month’s strong gain of 54,500. The unemployment rate unexpectedly fell from 6.6% to 6.5%. The Ivey Purchasing Managers Index did not disappoint as well, climbing […]

Read more July 7

July 72017

Pound Slides as Trend of Disappointing UK Economic Releases Continues

The Great Britain pound dropped today as macroeconomic indicators released in the United Kingdom continued to disappoint. Industrial production contracted 0.1% and manufacturing production declined 0.2% in May instead of rising as analysts had predicted. Construction output dropped 1.2%, and forecasters were wrong again with their predictions of growth. The trade balance deficit widened by £1.0 billion to £3.1 billion in May while experts had predicted it to stay almost unchanged. […]

Read more July 7

July 72017

Pound Slides as Trend of Disappointing UK Economic Releases Continues

The Great Britain pound dropped today as macroeconomic indicators released in the United Kingdom continued to disappoint. Industrial production contracted 0.1% and manufacturing production declined 0.2% in May instead of rising as analysts had predicted. Construction output dropped 1.2%, and forecasters were wrong again with their predictions of growth. The trade balance deficit widened by £1.0 billion to £3.1 billion in May while experts had predicted it to stay almost unchanged. […]

Read more July 7

July 72017

Japanese Yen Drops as BoJ Performs Bond Buying to Control Yield

The Japanese yen was in the red across the board as the surging yields on global bonds prompted the Bank of Japan to step in to keep the yield curve in check. The sell-off of global bonds caused the surge of yields. It was likely a result of the more hawkish stance of major central banks. In accordance to its yield control policy, the BoJ offered to buy an unlimited amount of 10-year Japanese government bonds. The aggressive bond buying resulted in losses for the yen. USD/JPY […]

Read more July 7

July 72017

Japanese Yen Drops as BoJ Performs Bond Buying to Control Yield

The Japanese yen was in the red across the board as the surging yields on global bonds prompted the Bank of Japan to step in to keep the yield curve in check. The sell-off of global bonds caused the surge of yields. It was likely a result of the more hawkish stance of major central banks. In accordance to its yield control policy, the BoJ offered to buy an unlimited amount of 10-year Japanese government bonds. The aggressive bond buying resulted in losses for the yen. USD/JPY […]

Read more