- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 13, 2017

July 13

July 132017

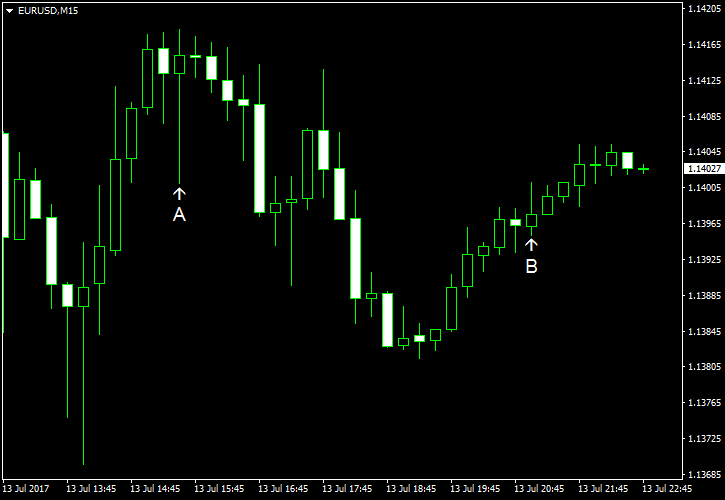

EUR/USD Stable After Mixed US Data

EUR/USD was stable today following mixed economic releases from the United States. Yesterday’s testimony from Federal Reserve Chairwoman Janet Yellen was dovish, but that did not prevent the currency pair from falling during the previous trading session. PPI rose 0.1% in June while experts had anticipated it to stay unchanged, the same as in May. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted […]

Read more July 13

July 132017

Swiss Franc Reverses Rally After Disappointing PPI

The Swiss franc started the current trading session rising but reversed its movement about the same time as the disappointing Producer and Import Price Index was released. The traders’ risk-positive mentality did not help the currency either. The Swiss PPI declined 0.1% in June compared to the previous month. While the reading was not as bad the May’s drop by 0.3%, it was still worse than the median forecast that promised no […]

Read more July 13

July 132017

AUD Boosted by Market Sentiment & Domestic Data

The Australian dollar rallied today thanks to the positive general market sentiment and domestic macroeconomic data. Yesterday’s dovish comments from Federal Reserve Chair Janet Yellen led to a rally of global stocks and the risk-on mode on a currency market. In particular, carry traders became more active, buying currencies of emerging markets and currencies linked to commodities. Meanwhile, the Melbourne Institute Consumer Inflationary Expectations for Australia rose from 3.6% in June to 4.4% in July. […]

Read more July 13

July 132017

AUD Boosted by Market Sentiment & Domestic Data

The Australian dollar rallied today thanks to the positive general market sentiment and domestic macroeconomic data. Yesterday’s dovish comments from Federal Reserve Chair Janet Yellen led to a rally of global stocks and the risk-on mode on a currency market. In particular, carry traders became more active, buying currencies of emerging markets and currencies linked to commodities. Meanwhile, the Melbourne Institute Consumer Inflationary Expectations for Australia rose from 3.6% in June to 4.4% in July. […]

Read more