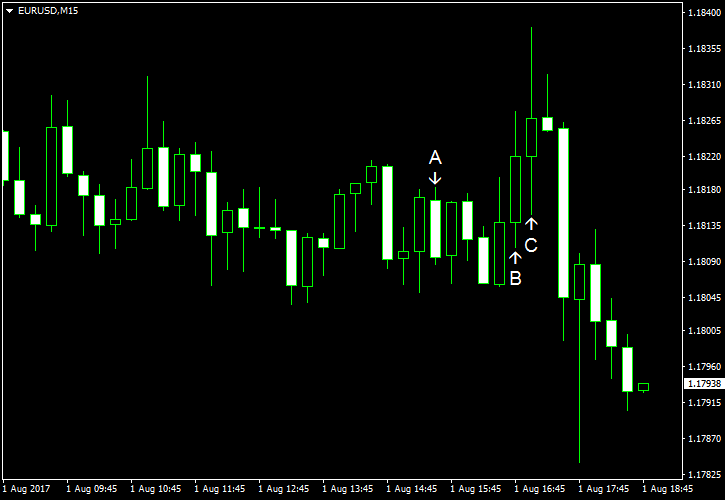

EUR/USD was gradually moving down today and logged a sharp drop just recently. Yet the currency pair remained near the

Personal income was unchanged in June, meaning that analysts were wrong with their forecasts of an increase by 0.4%. Moreover, the previous month’s gain was revised from 0.4% to 0.3%. Personal spending rose 0.1%, matching expectations, and the May increase was revised from 0.1% to 0.2%. Core PCE inflation also rose 0.1%, in line with predictions and the same as in the preceding month. (Event A on the chart.)

Markit manufacturing PMI rose from 52.0 in June to 53.3 in July according to the final estimate. The revised figure was very close to the analysts’ expectations and almost identical to the preliminary value of 53.2. (Event B on the chart.)

ISM manufacturing PMI, on the other hand, dropped from 57.8% in June to 56.3% in July. The reading was within predictions. (Event C on the chart.)

Construction spending shrank 1.3% in June from May instead of expanding by 0.4% as specialists had predicted. The May reading got a positive revision from no change to an increase by 0.3%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.