- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 1, 2017

September 1

September 12017

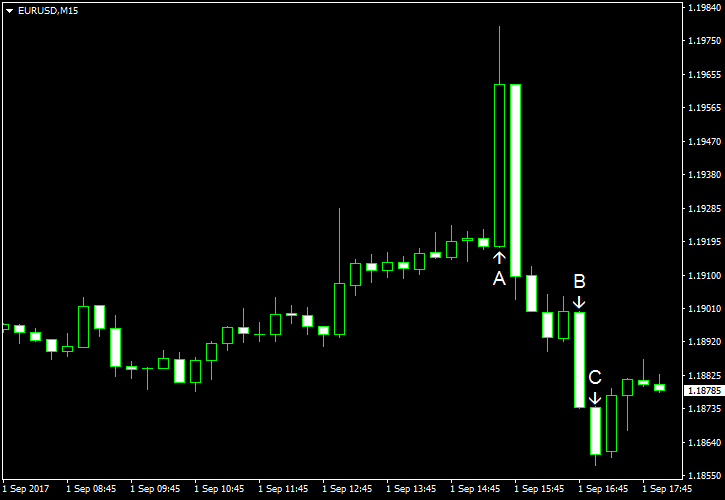

EUR/USD Quickly Reverses Gains Caused by Poor NFP

US nonfarm payrolls released today missed expectations. That caught market participants off-guard as they were counting on robust employment data following the very good private ADP report released earlier this week. Yet another surprise came in the form of reaction to the news demonstrated by EUR/USD. While the currency pair surged following the report, as it could be expected, it lost the gains very quickly and for whatever reason fell […]

Read more September 1

September 12017

CAD Logs Massive Gains, Touches Highest Since 2015 vs. USD

The Canadian dollar surged against its US counterpart today, touching the highest level since June 2015. The currency also posted massive gains versus other majors, seemingly without any apparent reason. The gains versus the greenback could be easily explained by the lackluster US employment data. The rally versus other rivals is harder to understand, especially as prices for crude oil, Canada’s major export, dropped. The possible reason […]

Read more September 1

September 12017

CAD Logs Massive Gains, Touches Highest Since 2015 vs. USD

The Canadian dollar surged against its US counterpart today, touching the highest level since June 2015. The currency also posted massive gains versus other majors, seemingly without any apparent reason. The gains versus the greenback could be easily explained by the lackluster US employment data. The rally versus other rivals is harder to understand, especially as prices for crude oil, Canada’s major export, dropped. The possible reason […]

Read more September 1

September 12017

US Shrugs Off Impact of Disappointing Nonfarm Payrolls

The US dollar dipped after the released of worse-than-expected nonfarm payrolls but reversed its losses quickly, bouncing against the euro. The greenback also gained on some other most-traded rivals, though not all of them. The employment report demonstrated slower-than-expected growth in August, which were surprising considering that the private data released earlier this week surprised to the upside. Moreover, the previous month’s increase was revised lower. Some analysts […]

Read more September 1

September 12017

US Shrugs Off Impact of Disappointing Nonfarm Payrolls

The US dollar dipped after the released of worse-than-expected nonfarm payrolls but reversed its losses quickly, bouncing against the euro. The greenback also gained on some other most-traded rivals, though not all of them. The employment report demonstrated slower-than-expected growth in August, which were surprising considering that the private data released earlier this week surprised to the upside. Moreover, the previous month’s increase was revised lower. Some analysts […]

Read more September 1

September 12017

EUR/USD Rallies Higher Briefly on Disappointing NFP Report, Tumbles Later

The EUR/USD currency pair today rallied higher briefly after the release of disappointing US non-farm payroll data during the American session, but quickly retraced all its gains. The currency pair’s rapid tumble was triggered by a Bloomberg report indicating that the European Central Bank was advocating for prudent policies in the face of the strong euro. The currency pair rallied to new daily tops, but quickly retraced all its gains […]

Read more September 1

September 12017

EUR/USD Rallies Higher Briefly on Disappointing NFP Report, Tumbles Later

The EUR/USD currency pair today rallied higher briefly after the release of disappointing US non-farm payroll data during the American session, but quickly retraced all its gains. The currency pair’s rapid tumble was triggered by a Bloomberg report indicating that the European Central Bank was advocating for prudent policies in the face of the strong euro. The currency pair rallied to new daily tops, but quickly retraced all its gains […]

Read more September 1

September 12017

Pound Finds Relief in Strong Performance of Manufacturing Sector

The Great Britain pound reversed earlier losses today thanks to the favorable manufacturing report that showed very strong performance of the sector. The currency was still under pressure from Brexit fears. The seasonally adjusted IHS Markit/CIPS Manufacturing Purchasing Managersâ Index climbed from 55.3 in July to 56.9 in August. That was the second highest level in almost three years. Yet the sterling remained under pressure as this week’s negotiations […]

Read more September 1

September 12017

Pound Finds Relief in Strong Performance of Manufacturing Sector

The Great Britain pound reversed earlier losses today thanks to the favorable manufacturing report that showed very strong performance of the sector. The currency was still under pressure from Brexit fears. The seasonally adjusted IHS Markit/CIPS Manufacturing Purchasing Managersâ Index climbed from 55.3 in July to 56.9 in August. That was the second highest level in almost three years. Yet the sterling remained under pressure as this week’s negotiations […]

Read more September 1

September 12017

Private Data Confirms Growth of China’s Manufacturing, Yuan Gains

Today’s private report confirmed yesterday’s official data that showed an improvement of China’s manufacturing sector. That allowed the Chinese yuan to appreciate even as China’s central bank set the daily fixing weaker. The Caixin China General Manufacturing PMI rose from 51.1 in July to 51.6 in August. The report said: Chinaâs manufacturing sector remained in expansion territory in August, fuelled by the strongest increase in new business for just over three years. […]

Read more