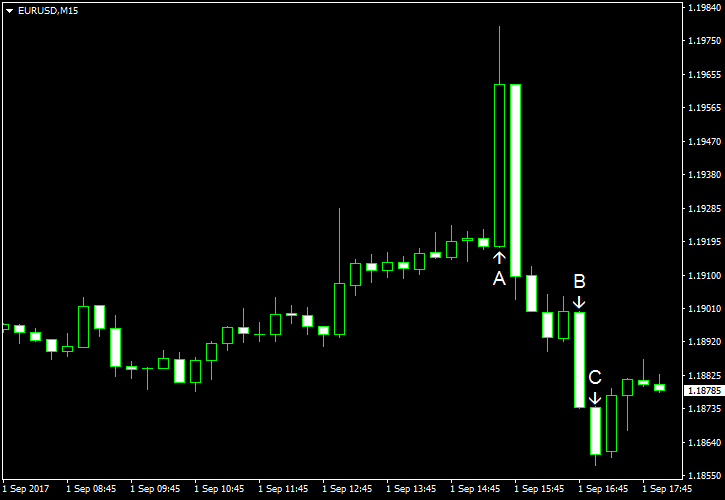

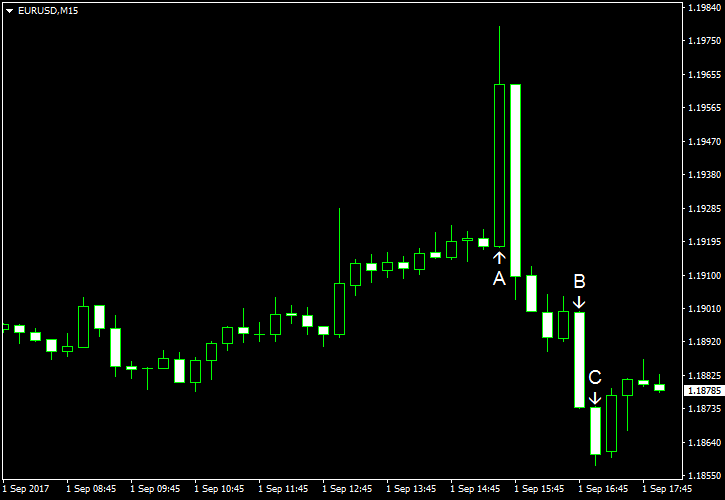

US nonfarm payrolls released today missed expectations. That caught market participants

Nonfarm payrolls rose by 156k in August, missing the figure of 180k promised by forecasters. What is more, the previous month’s increase got a negative revision from 209k to 189k. Unemployment rate ticked up unexpectedly from 4.3% to 4.4%. Average hourly earnings rose by 0.1%, less than 0.2% predicted by analysts and 0.3% registered in July. (Event A on the chart.)

Markit manufacturing PMI slipped from 53.3 in July to 52.8 in August according to the final estimate. Market participants expected the same 52.5 reading as in the preliminary estimate. (Event B on the chart.)

Meanwhile, ISM manufacturing PMI climbed from 56.3% in July to 58.8% in August. That is above the predicted figure of 56.5%. (Event C on the chart.)

Michigan Sentiment Index rose from 93.4 in July to 96.8 in August as was demonstrated by the revised data. Still, the actual value was below the predicted 97.4 and the preliminary figure of 97.6. (Event C on the chart.)

Construction spending fell 0.6% in July from June instead of rising 0.5% as analysts had predicted. The previous month’s drop got a slight revision from 1.3% to 1.4%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.