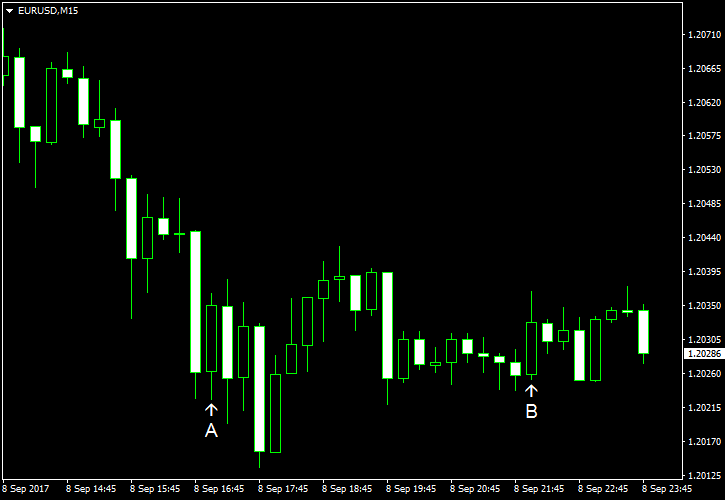

EUR/USD rallied during the Friday’s trading session but closed almost at the opening level. The dollar was generally weak on Friday due to a range of factors, including concerns about North Korea and possibility of another nuclear test by the rogue nation, decreasing chances for another interest rate hike from the Federal Reserve this year, and the threat from Hurricane Irma just shortly after the disastrous impact of Hurricane Harvey. As for US economic data, there were just a couple of reports on Friday, and they were not particularly important.

Wholesale inventories rose 0.6% while experts had anticipated the same 0.4% rate of growth as in June. (Event A on the chart.)

Consumer credit rose by $18.5 billion in July, exceeding the median forecast of $15.5 billion. Meanwhile, the June increase got a negative revision from $12.4 billion to $11.8 billion. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.