EUR/USD fell today even as US producer price inflation missed expectations. The miss was not big, though, and the markets’ attention was glued to tomorrow’s consumer price data anyway. Meanwhile, crude oil stockpiles continued to swell, while gasoline stockpiles were falling, as plenty of refineries were closed as a result of Hurricane Harvey.

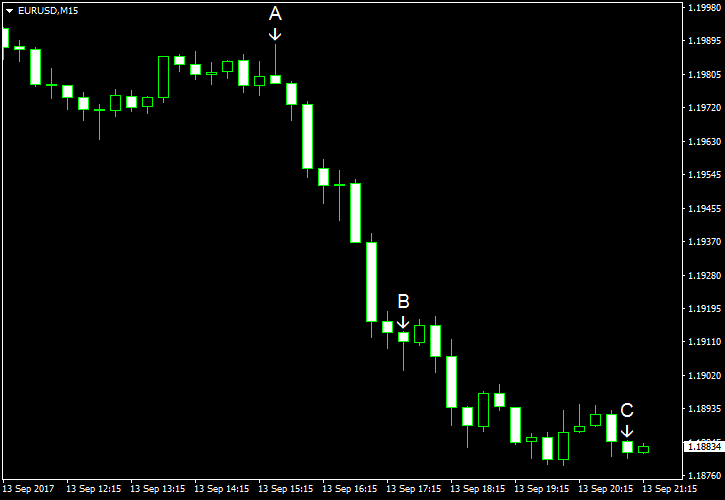

PPI rose 0.2% in August, seasonally adjusted. That was a better reading that the drop by 0.1% in July but worse than the median forecast of a 0.3% increase. (Event A on the chart.)

Crude oil inventories rose by 5.9 million barrels last week and were in the upper half of the average range for this time of year. The actual growth exceed the increase by 4.1 million predicted by experts and the 4.6 million gain registered in the prior week. Total motor gasoline inventories dropped by 8.4 million barrels last week but were in the upper limit of the average range. (Event B on the chart.)

Treasury budget deficit widened from $42.9 billion in July to $107.7 billion in August. Still, it was not as big as the $118.6 billion shortage forecast by analysts. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.