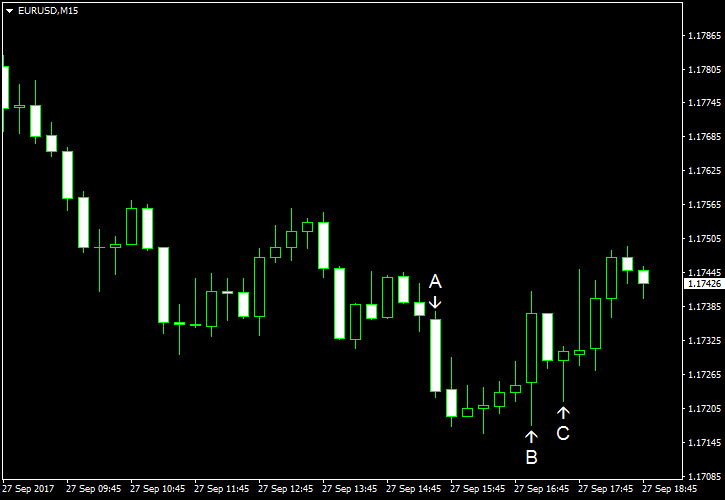

EUR/USD extended its decline for the third day today. US economic data was mixed, but traders paid more attention to the positive durable goods orders report than to the negative housing data. Yesterday’s speech of Federal Reserve Chairwoman Janet Yellen, which confirmed that the Fed is going to continue monetary tightening, also put pressure on the currency pair. Anticipation of a US fiscal reform announcement was also driving the dollar higher and sending the euro lower.

Durable goods orders rose 1.7% in August. That was a bigger increase than a 1.0% rise analysts had predicted. The indicator was down by as much as 6.8% in July. (Event A on the chart.)

Pending home sales were down 2.6% in August from July. It was far bigger than 0.5% predicted by analysts and 0.8% registered in the previous month. (Event B on the chart.)

US crude oil inventories fell by 1.8 million barrels last week but remained in the upper half of the average range for this time of year. That is instead of rising by 2.9 million as specialists had predicted. The stockpiles expanded by 4.6 million the week before. Total motor gasoline inventories rose by 1.1 million barrels last week and were also in the upper half of the average range. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.