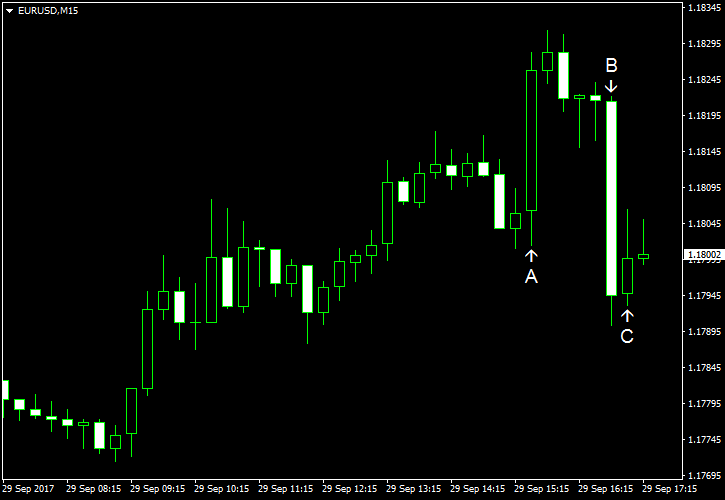

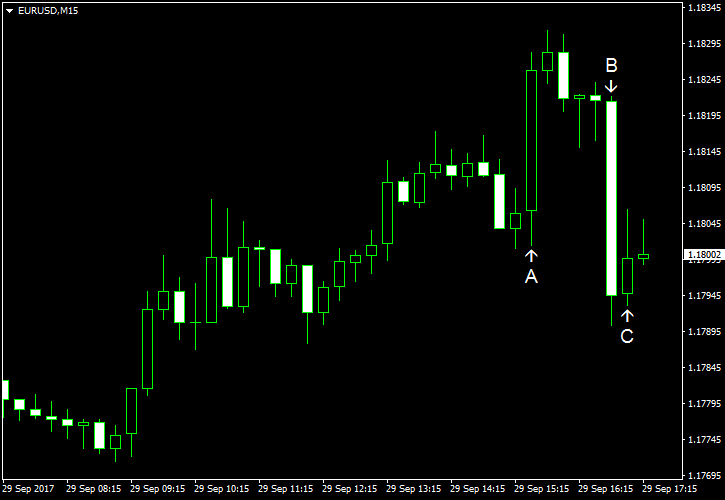

EUR/USD was rising today and extended its rally after core PCE inflation, the Federal Reserve’s favorite gauge of consumer price growth, missed expectations. The consumer sentiment, while close to expectations, fell. The only

Both personal income and spending increased in August, rising by 0.2% and 0.1% respectively, in line with expectations. Both indicators rose 0.3% in July. Core PCE inflation was at 0.1% in August, the same as in July and below the median forecast of 0.2%. (Event A on the chart.)

Chicago PMI rose from 58.9 in August to 65.2 in September. That surprised analysts as they were counting on a drop to 58.6. (Event B on the chart.)

Michigan Sentiment Index fell from 96.8 in August to 95.1 in September, according to the final reading. Experts were anticipating the same 95.3 reading as in the preliminary estimate. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.