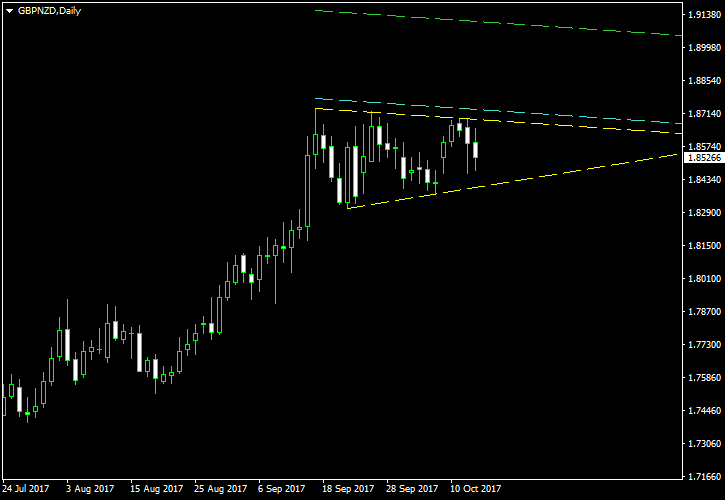

After this August’s failed symmetrical triangle pattern, GBP/NZD is consolidating in a fusion of ascending and symmetrical triangles. However, now it points towards an uptrend continuation following a bullish breakout from the previous symmetrical triangle.

On the image below, the pattern itself is marked using the yellow lines. The cyan line is my entry level located at 10% of the triangle’s height above the upper border. The green line will serve as my

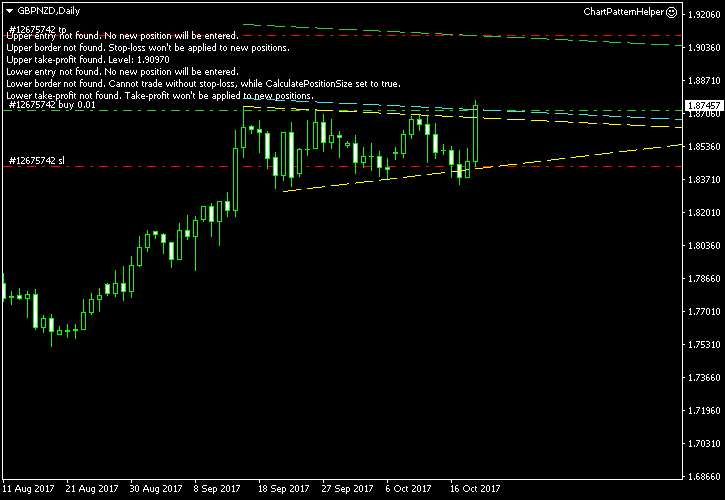

I have built this chart using the ChannelPattern script. You can download my MetaTrader 4 chart template for this GBP/NZD pattern. You can trade it using my free Chart Pattern Helper EA.

Update 2017-10-19 7:14 GMT: The long entry level was hit less than 4 hours ago at 1.87214 with

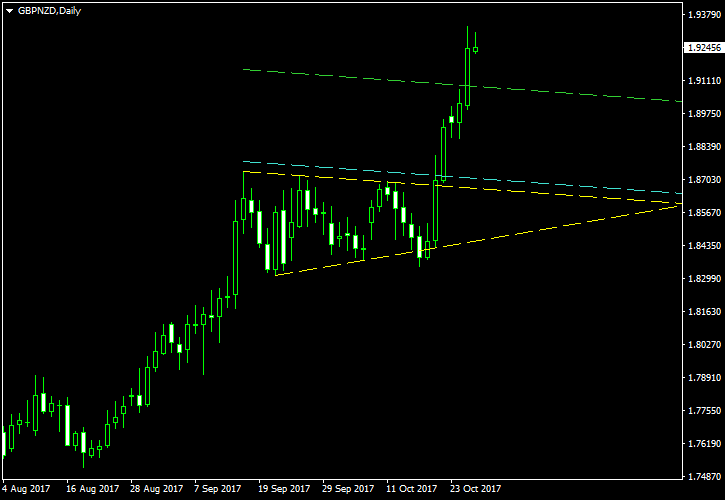

Update 2017-10-26: The

If you have any questions or comments regarding this symmetrical triangle on the GBP/NZD chart, please feel free to submit them via the form below.