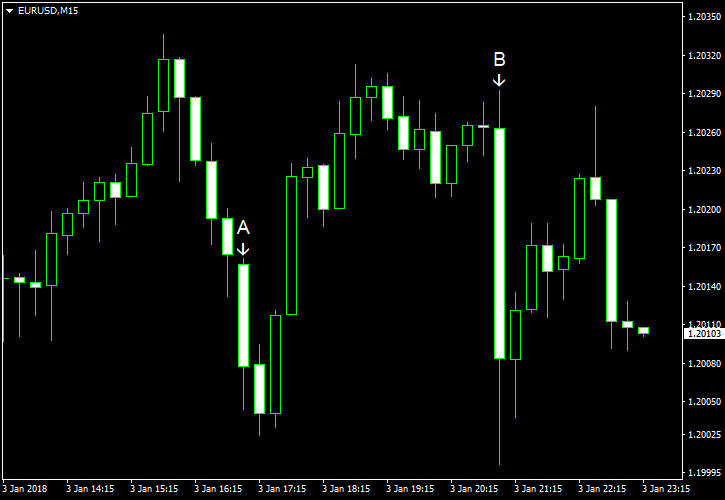

EUR/USD fell today as economic reports released in the United States in the course of the trading session beat market expectations. FOMC policy minutes had no big revelations, but the currency pair slid after they were released nonetheless.

ISM manufacturing PMI climbed from 58.2 in November to 59.7 in December, while analysts had expected the index stay little changed. (Event A on the chart.)

Construction spending rose 0.8% in November from October versus the forecast increase by 0.6%. The previous month’s increase was revised down from 1.4% to 0.9%. (Event A on the chart.)

FOMC minutes did not provide many new insights. (Event B on the chart.) The Committee members expressed worries about persistently low inflation but voiced confidence that it will rise to the central bank’s target eventually:

The Committee modified the previous statement language to make clear that it expects that inflation will rise gradually toward 2 percent as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate.

Yesterday, a report on Markit manufacturing PMI was released. It showed an increase from 53.9 in November to 55.1 in December, according to the final estimate. It was about the same as market expectations and the preliminary figure of 55.0. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.