- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 5, 2018

January 5

January 52018

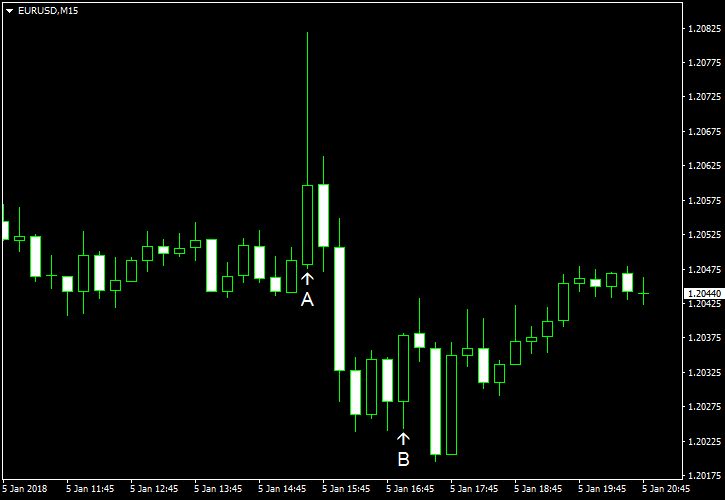

EUR/USD Fails to Stage Rally on Back of Weak NFP

US nonfarm payrolls came out worse than analysts expected. It was a stark contrast to the private ADP employment report released earlier this week, which surprised market participants positively. EUR/USD attempted to rise after the release, but the rally was extremely short-lived, and the currency fell below the pre-rally levels. Most other macroeconomic releases that came out over the current trading session were disappointing as well, […]

Read more January 5

January 52018

Australian Dollar Falls as Trade Balance Logs Unexpected Deficit

The Australian dollar fell against its major counterparts (with the exception of the Japanese yen) as the nation’s trade balance missed market expectations. Australia’s trade deficit rose from A$0.3 billion in October (negatively revised from the surplus of A$0.11 billion) to A$0.63 billion in November. It was nowhere near the excess of A$0.55 billion predicted by economists. The Australian currency dropped after the report, halting the earlier rally, though the Aussie managed to retain […]

Read more January 5

January 52018

Euro Declines Against US Dollar on Weak Eurozone CPI

The euro was on a downtrend against the US dollar for most of the European session having been in a consolidation phase during the Asian session. The single currency’s decline was largely precipitated by the modest recovery in the US dollar demand. The EUR/USD currency pair today lost about 40 points to decline from a session high of 1.2079 to a low of 1.2039 during the early European session. The release of the positive core Eurozone CPI data for December by Eurostat had […]

Read more January 5

January 52018

Yen Vulnerable as Traders Don’t Shun Risk

The Japanese yen together with the Swiss franc were the weakest currencies at the start of the year due to traders’ risk appetite. The last trading day of the week was not different as the yen slid against its most-traded rivals, reaching a new multi-year low versus the euro. Many global stock indices were at record highs, signaling about confidence among investors. Commodities and riskier currencies were also benefiting from the wide-spread risk […]

Read more