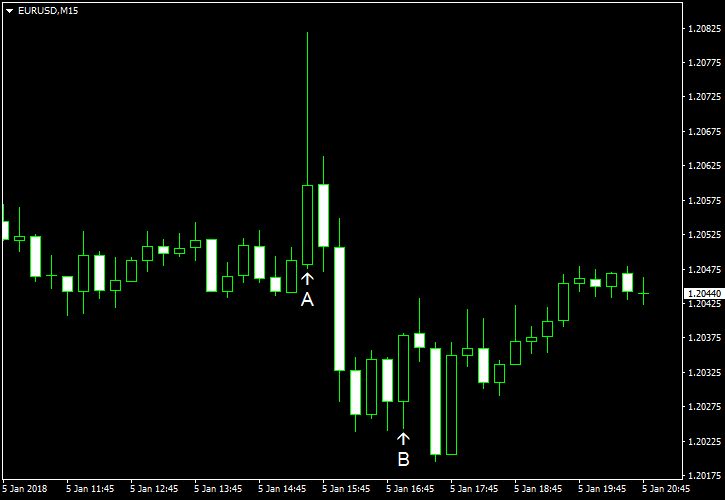

US nonfarm payrolls came out worse than analysts expected. It was a stark contrast to the private ADP employment report released earlier this week, which surprised market participants positively. EUR/USD attempted to rise after the release, but the rally was extremely

US nonfarm payrolls grew by 148k in December, far less than analysts had predicted — 190k. On a positive note, the November increase got a positive revision from 228k to 252k. Unemployment rate remained at 4.1%, as was expected. Average hourly earning rose 0.3% in December, also matching expectations. Meanwhile, the November increase, which had already missed forecasts, got a negative revision from 0.2% to just 0.1%. (Event A on the chart.)

Trade balance deficit widened to $50.5 billion in November up from $48.9 billion in October, while analysts had predicted a smaller increase to $49.7 billion. (Event A on the chart.)

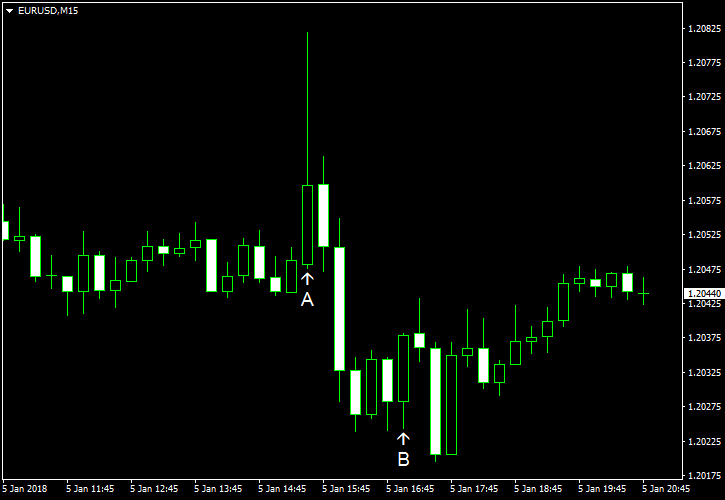

ISM services PMI from 57.4% in November to 55.9% in December. Most experts did not anticipate that, thinking that the index would edge up a little to about 57.6%. (Event B on the chart.)

Factory orders rose by 1.3% in November. That was the only positive surprise today as analysts had predicted a smaller increase by 1.1%. What is more, the October change was revised from -0.1% to +0.4%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.