The euro rallied against the US dollar earlier today on the rumors that China may reduce or stop its purchases of the US Treasury notes. The US dollar regained some of the losses after the initial upswing in EUR/USD and did not weaken much following lackluster domestic macroeconomic data.

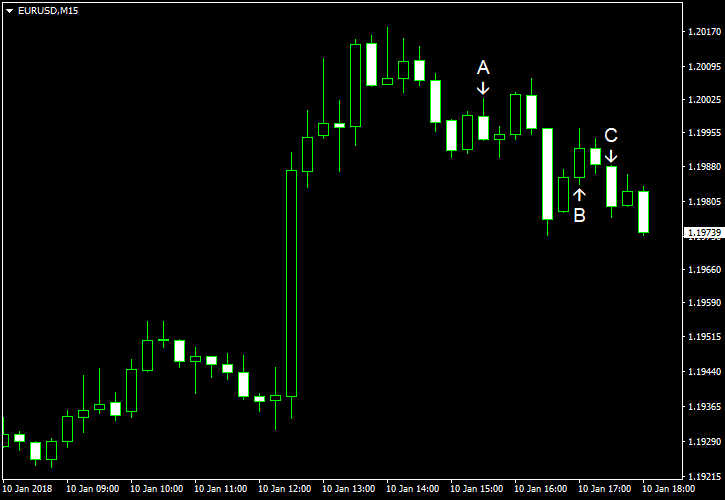

Export and import prices report disappointed the US dollar bulls. Import prices rose by 0.1% in December after rising by 0.8% in November. Meanwhile, export prices fell by 0.1% in contrast to 0.5% growth registered in November. Analysts expected 0.4% and 0.3% growth for import and export prices respectively. (Event A on the chart.)

Wholesale inventories added 0.8% in November after rising by 0.7% a month earlier. Market participants predicted a repetition of the 0.7% growth. (Event B on the chart.)

US crude oil inventories continued to decline during the week ending on January 5. They decreased by 4.9 million barrels, which was even faster than the forecast decline by 3.8 million barrels. Yet it was a slower fall than 7.4 million barrels decline reported a week earlier. Total motor gasoline inventories increased by 4.1 million barrels, following 4.8 million barrels growth a week before. (Event C on the chart.)

On Monday, a report on consumer credit has shown an increase by $27.9 billion in November. It was much stronger than $18 billion of the median forecast. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.