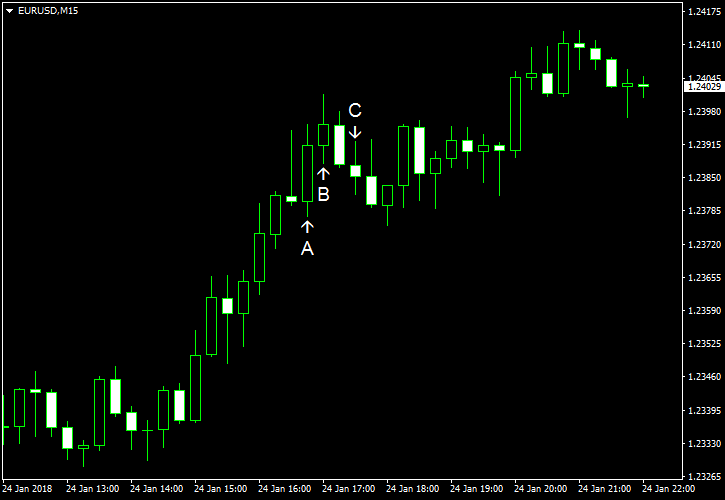

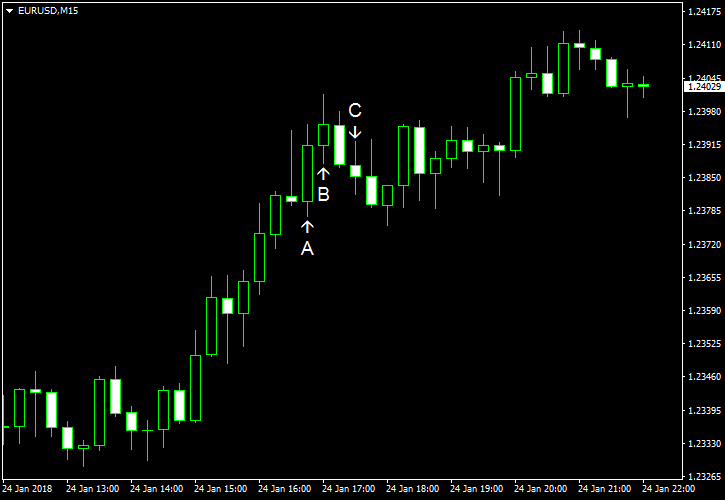

EUR/USD climbed to the highest level since the end of 2014 today after US Treasury Secretary Steven Mnuchin suggested that a weaker dollar is beneficial to the US economy. Economic reports released in the United States over the trading session were not helpful to the US currency either, with the manufacturing index being the only positive indicator.

Flash Markit manufacturing PMI rose from 55.1 in December to 55.5 in January, reaching the highest level in almost three years and demonstrating a bit higher reading than analysts had predicted — 55.2. At the same time, flash Markit services PMI dropped from 53.7 to 53.3, falling to the lowest level in 9 months and missing the average forecast of 54.5. (Event A on the chart.)

Existing home sales dropped from 5.78 million in November (revised down from 5.81 million) to 5.57 million in December. That was a far lower value than 5.72 million predicted by experts. (Event B on the chart.)

Crude oil inventories fell by 1.1 million barrels last week, in line with analysts’ expectations, but remained in the middle of the average range for this time of year. The stockpiles slumped by as much as 6.9 million the week before. Total motor gasoline inventories increased by 3.1 million barrels and were also in the middle of the average range. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.