EUR/USD was moving down earlier today but bounced later and is now trading above the opening level. There were plenty of economic releases in the United States during the current trading session, but most of them were either within or better than expectations, with just a couple of missteps. That means the economic data is unlikely to be a source of the rebound. Whether the currency pair bounced sharply due to the disappointment in the second testimony of the new Federal Reserve Chairman Jerome Powell or for some other reason, it is hard to tell at the present time.

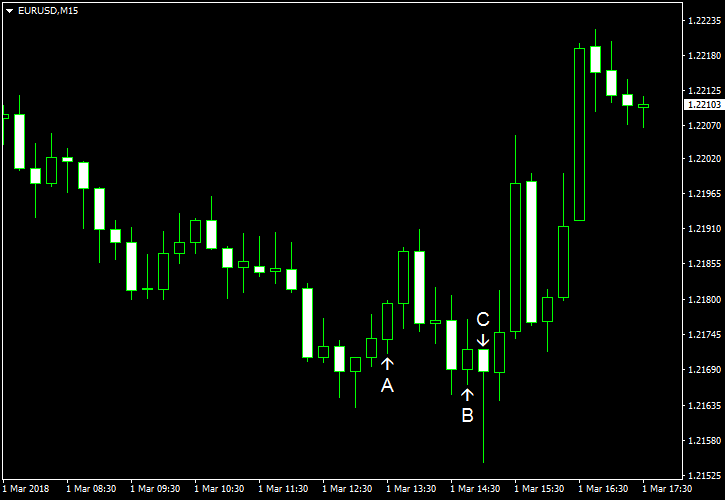

Personal income and spending rose in January. Personal income increased by 0.4%, the same as in December and a bit faster than analysts had forecast — 0.3%. Personal spending was up 0.2%, matching expectations and slowing from the 0.4% rate of growth registered in the prior month. Core PCE inflation was at 0.3%, also within expectations, but accelerating from the previous month’s 0.2%. (Event A on the chart.)

Initial jobless claims dropped from 220k to 210k last week, while analysts had forecast an increase to 226k. (Event A on the chart.)

Markit manufacturing PMI slipped a little from 55.5 in January to 55.3 in February according to the final estimate, whereas market participants were expecting the same 55.9 figure that was shown in the preliminary estimate. (Event B on the chart.)

Meanwhile, ISM manufacturing PMI advanced from 59.1% in January to 60.8% in February instead of falling to 58.7% as experts had predicted. (Event C on the chart.)

Construction spending showed no change in January from December. That was a noticeably worse reading than an increase by 0.3% predicted by specialists and the December growth by 0.8%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.