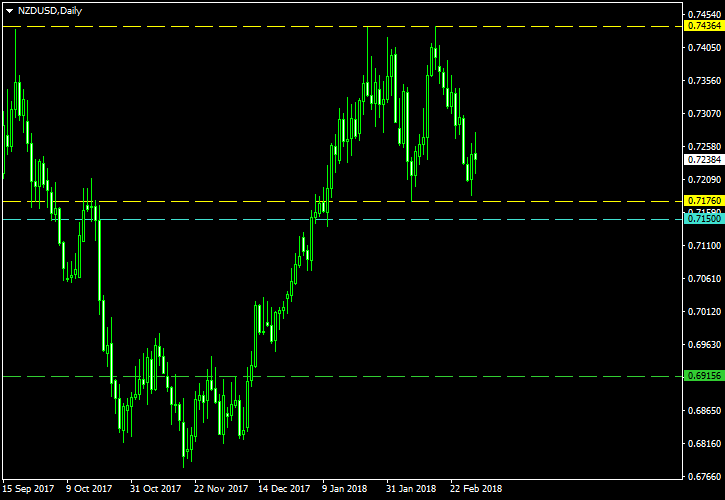

Having bounced twice from the horizontal resistance level near 0.7436, the New Zealand dollar has seemingly stopped its advance against the US counterpart. The uptrend, which lasted from

The yellow lines mark the tops and the “neckline” of the pattern. The cyan line is my potential entry level. It is placed at 10% of the pattern’s height below the “neckline.” The

I have built this chart using the ChannelPattern script. You can download my MetaTrader 4 chart template for this NZD/USD pattern. You can trade it using my free Chart Pattern Helper EA.

If you have any questions or comments regarding this double top on the NZD/USD chart, please feel free to submit them via the form below.