To get the Asia AM Digest every day, SIGN UP HERE

Thursday was a day of broad US Dollar strength which weighed against most of the major peers. An improvement in sentiment saw Wall Street finish another day higher as trade wars fears continued to ebb from the past few days. In fact, the greenback brushed aside a larger US trade deficit and more jobless claims.

Earlier in the day, Donald Trump’s top economic adviser Larry Kudlow certainly helped fuel this behavior. Mr. Kudlow mentioned that he expects the US and China to get an agreement on a trade deal “over a period of time”. Officials seem more confident that their progress won’t end up in Chinese product tariffs.

Needless to say, the anti-risk Japanese Yen didn’t perform so well. Despite the ‘risk on’ setting, sentiment-linked currencies like the Australian and New Zealand Dollars finished the day mostly lower. Perhaps this was a result of investors being more interested in the increasingly higher-yielding greenback.

Once currency that stood tall above all else was the Canadian Dollar. The Loonie was bolstered by continued progress on NAFTA talks. Canada’s Prime Minister Justin Trudeau said that talks are moving forward in a ‘significant way’. Meanwhile Mr. Trump said that a deal will likely come ‘fairly soon’. With that in mind, USD/CAD prices could continue to fall amidst a reversal pattern.

Meanwhile the British Pound was another poor performer. Though at the time, it was initially unaffected by by the weakest UK services PMI in 20 months.

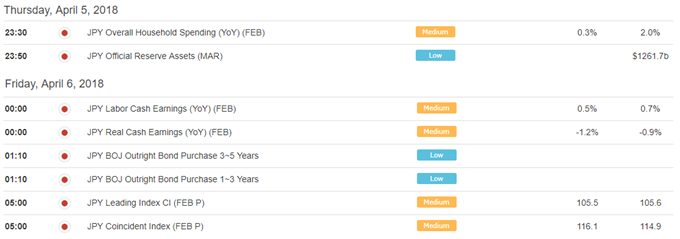

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

![]()

![]()

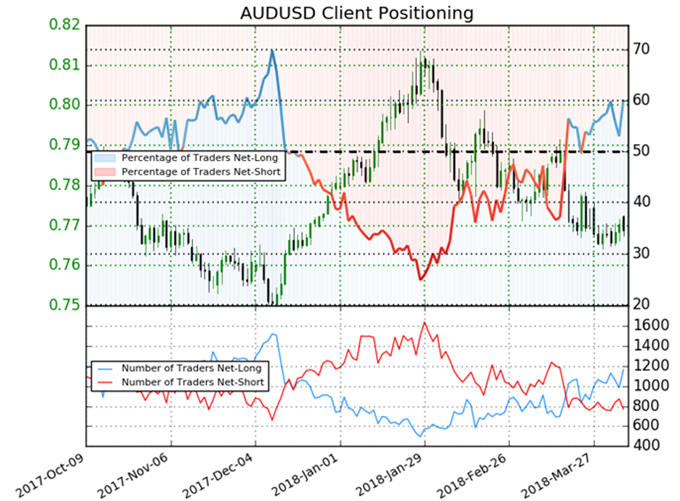

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 60.2% of AUD/USD traders are net-long with the ratio of traders long to short at 1.51 to 1. In fact, traders have remained net-long since Mar 22 when AUD/USD traded near 0.77738; price has moved 1.1% lower since then. The number of traders net-long is 5.3% higher than yesterday and 8.0% higher from last week, while the number of traders net-short is 2.4% lower than yesterday and 8.2% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bearish contrarian trading bias.

Five Things Traders are Reading:

- NFP Preview: Price Action Setups Around the US Dollar by James Stanley, Currency Strategist

- Sentiment Towards Bitcoin Shifts Signaling a Strong Contrarian Bias by Dylan Jusino, DailyFX Research

- USD/CAD Technical Outlook: Trade Setups for NFP, Canada Jobs by Michael Boutros, Currency Strategist

- Central Bank Weekly: US Dollar Taking Few Cues from Fed Rate Pricingby Christopher Vecchio, Senior Currency Strategist

- US Dollar Catches a Bid Ahead of Non-Farm Payrolls (NFP)by Michael Boutros, Currency Strategist

To get the Asia AM Digest every day, SIGN UP HERE

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here