Talking Points:

- FOMC minutes due out on Wednesday; S&P 500 thoroughly testing support

- Calendar light in Germany/Euro-zone; DAX bounce at sizable risk

- No major economic data out of the U.K., FTSE rally for real?

For the intermediate-term technical and fundamental outlook, check out the recently released DailyFX Q2 Forecasts.

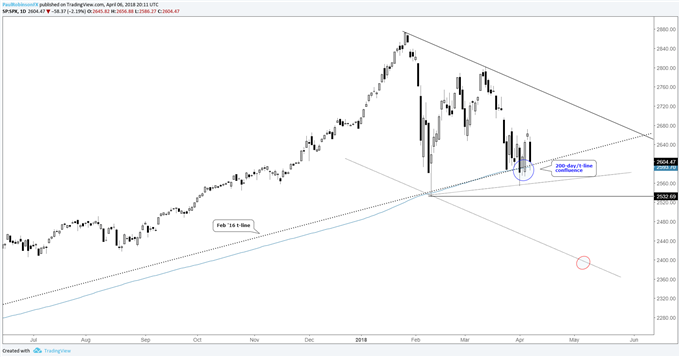

S&P 500

On Friday, U.S. Non-farm payrolls came in at 103k versus the consensus estimate of 185k, prior month revised up to 326k from 313k. The unemployment rate was 4.1% compared to 4.0% expected. This caused the S&P futures to gyrate in both directions pre-market, but nothing material net-net by the open.

Looking ahead to next week, we have a couple of key events highlighted by the release of the minutes from the March FOMC meeting on Wednesday. Also, due out earlier that day is March CPI, and the other ‘high’ impact data to be released arrives on Friday via the April preliminary UofM Sentiment survey. For full details on timing and estimates of all economic releases, check out the economic calendar.

The S&P found significant sponsorship around the 200-day MA and the February trend-line last week, which helped put a rebound in place until Friday. Friday’s sell-off once again brought significant support back into play. Should it fail convincingly next week another major swoon could be in store. Watch the Dow, as it has a descending wedge top developing and suggests a major dive could soon be in store.

S&P 500: Daily

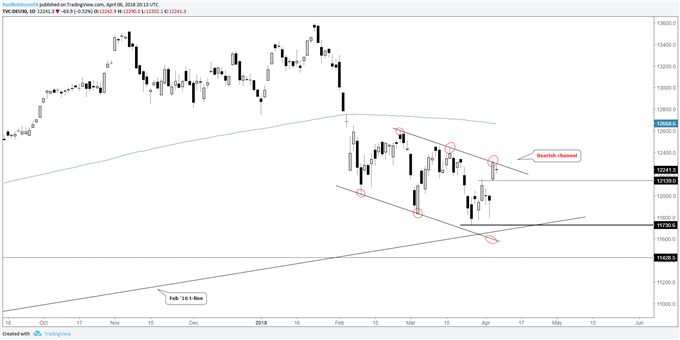

DAX

It’s a quiet week ahead on the economic calendar, with no ‘high’ impact data releases set to be released. Keep an eye on the reaction in U.S. markets on Wednesday following the release of the FOMC minutes. Risk trends will likely be a dominant theme in the week ahead.

The DAX, which had previously been a significant laggard behind the stronger U.S. market, found good strength last week and put together a large reflexive rally. The bounce took it up to the top of a bearish channel it continues to trade inside, with its beginnings dating back to February.

With the index turning down off the top of the channel, risk is for it to trade lower towards the February 2016 trend-line. If risk sentiment sours materially, as the Watch the Dow suggests, then it shouldn’t be long before another large leg lower develops. From a risk/reward perspective, shorts at the top of the bearish channel offer an attractive risk/reward entry, with stops above the Thursday high of 12322.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

DAX: Daily

FTSE

The major economic release this coming week doesn’t arrive until Thursday when the BoE Credit Conditions & Bank Liabilities Surveys are due out. As with other major markets, any sizable move out of the U.S. on Wednesday is likely to impact the open of trade on Thursday.

Last week, the FTSE continued to put together a surprisingly strong bounce. The rally cleanly took out the 7100-level, and now has the 7300-area in focus should upward momentum continue. However, if we are to see another global swoon commence, then it may not make it to that point. However, at this time, in our view, there are better candidates for shorts, the Dow and DAX to name a couple,

FTSE: Daily

—Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at@PaulRobinsonFX