Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA +0.5%, NASDAQ 100 +0.5%, S&P 500 +0.5%

USD: Tepid price action for the US Dollar for much of the morning after its recent stellar gains, the key 3% level in the US 10-year treasury yield is holding for now and as such keeping a further rise in the USD at bay. Little in the way of major economic data points, which may suggest that a clean break from the key 3% level may be on hold for now.

EUR: Narrow 40 pip range for the Euro, currently holding 1.2200 after a brief dip through to 1.2180. Uninspiring German data continued with the latest IFO survey this morning, all major components saw a sizeable dip in April, business expectations dropping to its lowest level since August 2016 amid concerns that the German economy is slowing down.

AUD: The Australian saw a somewhat choppy price action in the wake of the latest inflation figures which had been somewhat mixed. Australian CPI fell short of expectations at 1.9% (Exp. 2%) with Q1 CPI falling to 0.4% from 0.6%, however the RBA’s preferred measure of inflation (Trimmed mean) rose ahead of consensus at 1.9% (Exp. 1.8%). Ultimately, not a game changer for the RBA who are expected to keep interest rates on hold for 2018.

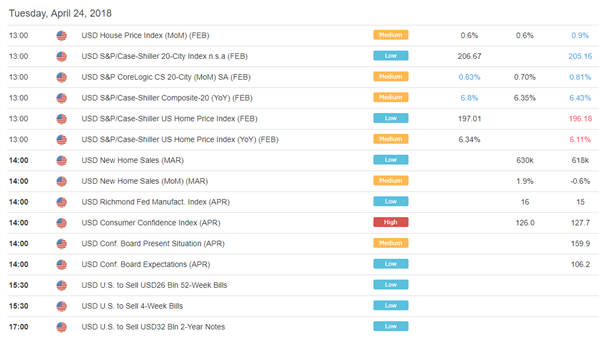

DailyFX Economic Calendar: Tuesday, April 24, 2018 – North American Releases

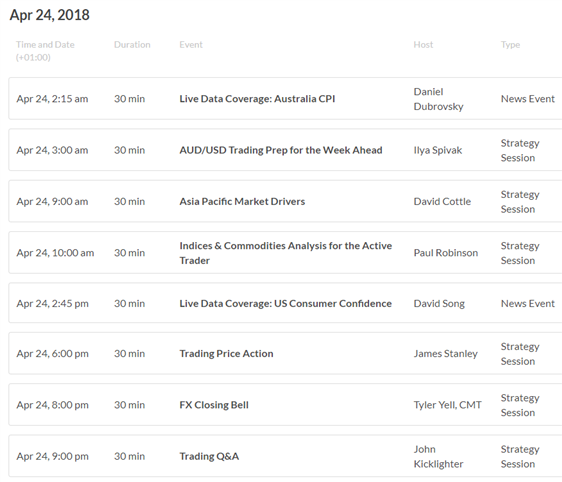

DailyFX Webinar Calendar: Tuesday, April 24, 2018

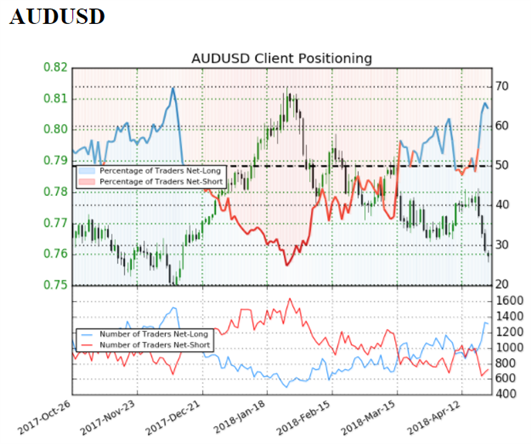

IG Client Sentiment Index Chart of the Day: AUDUSD

AUDUSD: Data shows 64.4% of traders are net-long with the ratio of traders long to short at 1.81 to 1. The number of traders net-long is 11.4% higher than yesterday and 27.3% higher from last week, while the number of traders net-short is 6.3% higher than yesterday and 25.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Five Things Traders are Reading

- “DXY Bottoming Effort Takes Step Forward as Three More Hikes Eyed in 2018” by Christopher Vecchio, Senior Currency Strategist

- “US Dollar Boosted by Bond Yields, EURUSD Likely to Fall Further” by Nick Cawley, Market Analyst

-

“

The South African Rand Starting to Reverse Course”

by Shaun Murison, Technical Strategist - “Dismal U.S. Consumer Confidence Survey to Curb EUR/USD Weakness” by David Song, Currency Analyst

- “DAX & CAC Technical Outlook – More Strength Ahead?” by Paul Johnson, Market Analyst

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX