Crude oil talking points:

– The prospect of new sanctions on Iran and concerns about Venezuela are lifting crude oil prices.

– Now, a further climb towards the $70/barrel level for the US contract seems plausible.

Check out the IG Client Sentiment data to help you trade profitably.

And take a look at our Q2 forecasts for crude oil.

Crude oil prices

The recent strength of the US crude oil price looks set to continue amid concerns that the US may decide by May 12 to abandon a nuclear deal with Iran and re-impose sanctions. In addition, worries about production in Venezuela are mounting amid an increasingly hostile environment for oil companies there. Both countries are major oil producers.

Yesterday, the underlying strength of crude oil was emphasised by the lack of a major response to news that US crude oil inventories rose unexpectedly last week, according to a bearish report from the US Energy Information Administration.

US Crude Oil Price Chart, Daily Timeframe (December 12, 2017 – April 26, 2018)

US crude technicals

From a technical perspective, the price of US crude has been rising steadily since touching a 2018 low of $57.93 per barrel on February 9 and now looks poised to retest the psychologically-important $70 mark after reaching a $69.54 high last Thursday. To the downside, trendline support at $67.53 should limit the downside.

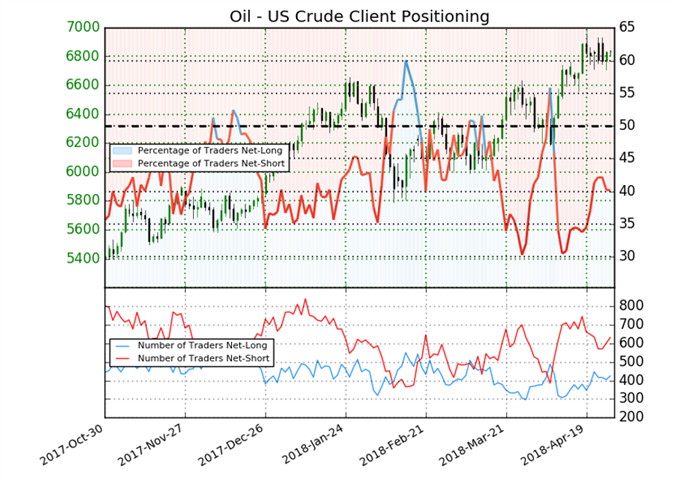

Oil sentiment data mixed

However, IG client sentiment data paint a less positive picture. Retail trader data show 40.2% of traders are net-long, with the ratio of traders short to long at 1.49 to 1. In fact, traders have remained net-short since April 9, when US crude traded near $63.73; the price has moved 7.4% higher since then. The number of traders net-long is 0.5% higher than yesterday and 8.4% higher from last week, while the number of traders net-short is 1.1% higher than yesterday and 16.1% lower from last week.

At DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests the US crude price may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a mixed trading bias.

Resources to help you trade the forex markets

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you: analytical and educational webinars hosted several times per day, trading guides to help you improve your trading performance, and one specifically for those who are new to forex. You can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

— Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex